By FX Empire.com

Rule: Gold prices always rise when there is uncertainty in the global economy. In times of uncertainty, wealthy investors tend to run towards gold. Suppose, rumors are flying high about some event in the world and this is increasing the uncertainty in the financial markets. Gold prices are on the rise again. You now buy three gold contracts. By the end of the week, each contract is up by 100 points. You make a cool $3,000 when you sell the three contracts. This way, you complete your third trade in a series of four trades.

This is a very simple gold trading strategy that depends on pyramiding your position with a series of four trades and removing all the profit from your account at the end of these four trades. With practice, you will find this gold trading strategy very simple and easy to implement.

- Gold reacts to uncertainty in the markets

- A drop in major currencies can indicate a run into gold.

- Remember investors tend to take profit from gold so watch for trading opportunities when investors are taking profits, not moving out of the markets.

Gold Weekly Fundamental Analysis March 12-16, 2012, Forecast

Analysis and Recommendations:

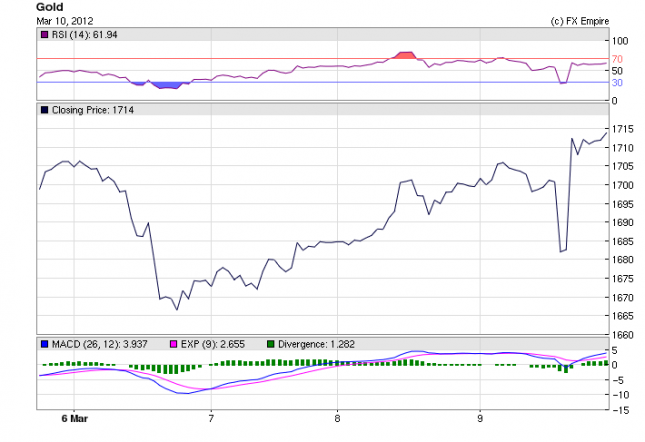

Gold continued a third straight session, after falling in early trading it moved up tied to positive U.S. jobs data to join oil and other metals in a commodities rally.

Gold ended the day up $12.80; at $1,711.50 an ounce Prices increased 0.1% on the week. The old adage, gold up dollar down is not holding true this week. Gold should begin to start to fall as investors move to more risky trades and away from safe havens. This week should be a down week for gold. Last week gold moved between a high of 1725.40 and a low of 1662.50. There is a major line of support at 1650.00 and I would expect Gold to fall to that level this week

Highlights of the past week

USA

The U.S. created 227,000 jobs in February and more people found work in the prior two months than previously reported, suggesting the economy’s recent momentum is likely to continue.

The unemployment rate, meanwhile, was unchanged at 8.3% as nearly half-a-million workers reentered the labor force in search of job, the Labor Department.

Household debt edged up 0.3% in the fourth quarter, the Fed reported in its flow-of-funds report, as consumer credit surged at a 7% annualized rate. Household debt had declined for 13 consecutive periods before the slender fourth-quarter advance.

The U.S. trade deficit widened sharply in January, driven higher by record imports of autos, capital goods and food, government data reported. The trade gap expanded 4.3% in January to $52.6 billion from $50.4 billion in December.

The Fed is considering a new form of “sterilized” quantitative easing that would allow asset purchases despite high oil prices, according to a report in The Wall Street Journal. Under the new approach, the Fed would print new money to buy long-term mortgage or Treasury bonds but effectively tie up that money by borrowing it back for short periods at low rates. The aim of such an approach would be to relieve anxieties that money printing could fuel inflation later, a fear widely expressed by critics of the Fed’s previous efforts to aid the recovery.

The Canadian Central Bank held rates today at 1% following the lead of banks around the world.

The Institute of Supply Management said its non-manufacturing PMI climbed to 57.3 in February from a reading of 56.8 the previous month. Economists had expected the index to decline to 56.1.

Another report showed that U.S. factory orders fell, but at a slower than forecast rate in January, declining by a seasonally adjusted 1.0%, compared to forecasts for a 1.3% slide.

Europe

The International Swaps and Derivatives Association said Friday that the Greek government’s use of collective-action clauses, or CACs, to amend to terms of Greece-issued bonds qualifies as a “credit event” for Greece. A credit event requires a payout to those who held credit default swaps as insurance to protect them in the event of a Greek default.

The Fitch ratings agency downgraded Greece to “restricted default” over the bond swap — a move that had been expected. Fitch was the third agency to downgrade Greece into default, after Moody’s and Standard & Poor’s.

The deal is done, finally. Greece finished their debt swap with private creditors. Bondholders representing some 85% of Greece’s outstanding private-sector debt, well above the government’s minimum threshold, have agreed to the swap, easing pressures on the eurozone.

Conditions are in place for Greece to get its second bailout, said Eurogroup President Jean-Claude Juncker in a statement released Friday. “I welcome the significant progress achieved in the preparation of the second Greek adjustment program,” said Juncker, after a teleconference between euro-zone finance ministers on Friday

The Bank of England announced their current rate decision which was as expected to hold rates. No new additions to their monetary easing policies announced in February.

The European Central Bank committee held lending rates at the current rate of 1% and made no comments on any additional lending policies.

German production climbed 1.6% from December. Economists were expecting an increase of 1.1% in the euro zone’s largest economy.

EU’s Rehn: Eurozone Currently in a Mild Recession but Signs of Improvement but, risk of credit crunch in European economy has been prevented largely due to long-term liquidity offer of ECB. The Commission supports combining remaining resources of EFSF with ESM to make sturdier European firewall.

Historical

High: 1916.20

Low: 1321.10

The week ahead brings a vast assortment of economic indicators. A busy week with the news dominated by the US interest rate decision and inflation data.

Monday sees data on credit card lending and debt released by the RBA in Australia.

Also we have housing finance data and new car sales figures will be released. As well as the Reserve Bank of Australia will release its March quarter bulletin.

The Bank of Japan will make its interest rate decision for March.

In Europe, European Union finance ministers are scheduled to meet.

Mondaysees the United Nations economic and social council hold its annual spring meeting

The US treasury budget data will be released.

On Tuesday, the Australian Bureau of Statistics will release housing finance data for January. National Australia Bank is due to release its business confidence and conditions index for the month of February.

IN the US, the Federal Reserve hold its March meeting, where it will decide on the current level of interest rates in the country. Also January business inventories and February retail sales data are also due.

Also on Tuesday, The World Trade Centre committee on budget, finance and administration will hold a meeting.

Chinese Premier Wen Jiabao will hold his annual press briefing at the China National People’s Congress.

Wednesday sees the ABS release December housing starts data. Westpac Banking Corporation and the Melbourne Institute will release their consumer sentiment index for March.

In the United Kingdom, average earnings data for the three months to March will be released. Also February claimant count data and ILO unemployment rate figures for March will also be released.

Across the Atlantic US import and exports price data released, while current account balance data for the December quarter is due.

The weekly Energy Information Administration petroleum status report is also on tap, as well as weekly Mortgage Bankers Association mortgage applications data.

Wednesday afternoonsees World Bank deputy vice finance minister for international affairs Masatsugu Asakawa address a eurozone crisis conference hosted by the Asia Development Bank Institute.

US Federal Reserve chairman Ben Bernanke will speak at the 2012 Independent Community Bankers of America national convention

Thursday brings January lending finance data for the month of January in Australia also new car sales data for February is also set for release.

Elsewhere, the Melbourne Institute will release both its consumer inflation and employment expectation surveys for March.

Thursday morningdelivers US jobless claims data and the February producer price index in the US.

Along with several other releases in America including, The Philadelphia Federal Reserve survey and the US Treasury international capital data is on tap, alongside the New York Empire State Manufacturing Survey.

Friday brings highly anticipated consumer price index data for February in the US.

The Reuters/Michigan consumer sentiment index for March and industrial production for February data will also be released.

On Saturday, the Organization for Economic Co-operation and Development will release its interim assessment.

Economic Events in the USA this week

|

Mar. 12 |

19:00 |

USD |

Federal Budget Balance |

|

Mar. 13 |

12:30 |

USD |

Core Retail Sales (MoM) |

|

12:30 |

USD |

Retail Sales (MoM) |

|

|

18:00 |

USD |

10-Year Note Auction |

|

|

18:15 |

USD |

Interest Rate Decision |

|

|

18:15 |

USD |

FOMC Statement |

|

|

Mar. 14 |

12:30 |

USD |

Current Account |

|

12:30 |

USD |

Import Price Index (MoM) |

|

|

Mar. 15 |

12:30 |

USD |

Core PPI (MoM) |

|

12:30 |

USD |

PPI (MoM) |

|

|

12:30 |

USD |

Initial Jobless Claims |

|

|

12:30 |

USD |

NY Empire State Manufacturing Index |

|

|

12:30 |

USD |

Continuing Jobless Claims |

|

|

13:00 |

USD |

TIC Net Long-Term Transactions |

|

|

14:00 |

USD |

Philadelphia Fed Manufacturing Index |

|

|

Mar. 16 |

12:30 |

USD |

Core CPI (MoM) |

|

12:30 |

USD |

CPI (MoM) |

|

|

13:15 |

USD |

Industrial Production (MoM) |

|

|

13:55 |

USD |

Michigan Consumer Sentiment Index |

Government Bond Auction Schedule (this week)

Mar 12 10:30 Germany Eur 4.0bn new Sep 2012 Bubill

Mar 12 18:00 US Auctions 3Y Notes

Mar 13 09:30 Netherlands Eur 2.5bn-3.5bn re-opened Apr 2015 DSL

Mar 13 10:10 Italy BOT auction

Mar 13 10:30 Belgium Auctions 3 & 12M T-bills

Mar 13 15:30 UK Details gilt auction on Mar 22

Mar 13 18:00 US Auctions 10Y Notes

Mar 14 10:10 Italy BTP/CCTeu auction

Mar 14 10:10 Sweden Auctions T-bills

Mar 14 10:30 Swiss Bond auction

Mar 14 15:30 Sweden Details nominal bond exchange auction on Mar 21

Mar 14 18:00 US Auctions 30Y Bonds

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here