By: Scott Redler

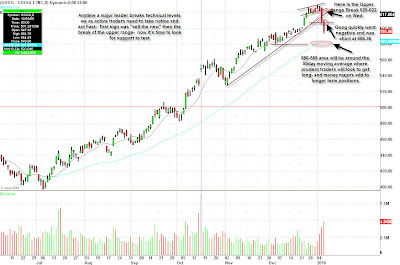

My analysis on Google (GOOG) was purely technical–we are market timers and use technical analysis as our guide. Anytime you have a major “event” like the launch of a smart phone–the Nexus One–stocks are prone to a sell the news phenomenon. This is especially true when the stock has made a major run into the announcement. As active traders, we were ready to either buy Google if it maintained its momentum and moved above that upper range ($620-629), or to short the stock on a break of the upper trendline.

Once they sold the news and the stock went into the middle of the upper range we had an initial sign that momentum was waning. As a result, on Wednesday we sent out notes that if GOOG breaks the $620 area, get out of short term longs and look for a short trade. GOOG closed the day on its lows, confirming weakness in price.

Today, it opened up slightly and immediately went negative–yet another bearish sign–allowing for great trades to those who prepared properly for the day. Mid-morning, when Goldman Sachs (GS) upgraded GOOG and there was no bounce, that added fuel to the downside. Prepared traders left their longs near the highs, and quick traders flipped short and could be up by as much as $25 points already.

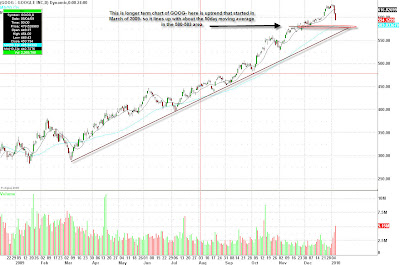

With the weakness in GOOG, we saw the other horsemen of tech–Apple (AAPL), Amazon (AMZN), and Priceline (PCLN)–all see some selling. Prepared traders MUST take notice when there is a kink in the armor of a market leader–especially after a major runup, and a major event. The next big support level will be the 50-day moving average at around $583, which coincides with a longer-term uptrend line.