|

| Likely new House Speaker John Boehner (R-Ohio) |

Election results are in! The GOP scored massive wins across the country to regain a strong majority in the House of Representatives, while the Democrats held onto the Senate. As indicated yesterday, political gridlock, contrary to popular belief, is not necssarily good for the markets. It will be interesting to see whether the split Congress can get anything done, and whether both parties will reach across the aisle for compromist or Republicans will make obstruction their primary policy goal.

Now that the elections are behind us and there were no big surprises we can focus on the event with more direct relevance to the markets: the Federal Reserve FOMC announcement on QE 2. The S&Ps are opening above recent highs. The first question is, how far do they stretch it before the 2:15pm ET announcement? The second question, obviously, will be how the market receives the news. It’s not clear how the market would react under each scenario (lower, higher or in line with expectations). If QE 2 comes in light, for example, the market could be disappointed and sell-off, or could trade higher, as perhaps the ‘small’ number be viewed as a sign that the economy is improving to the point that massive monetary easing is not neccesary. The pivot line to watch is 1197. The bottom line right now is that stocks are acting well following a very strong earnings season that showed a clean bill of health for the American corporate landscape. We’ve had some nice scoops in the go-to list of strong stocks, as most held at or above their 21 day moving average and tested recent break outs.

Everyone is all fired up about what will be America’s “New Direction”. I share some of that optimism, but a new set of politicians has never changed anything before. How about getting fired up about how you can be a better citizen/parent/husband/wife/brother/sister/son/daughter/market participant. No elected official is going to change our lives. Only we can take the right steps to control our actions, and become better individuals to make America better.

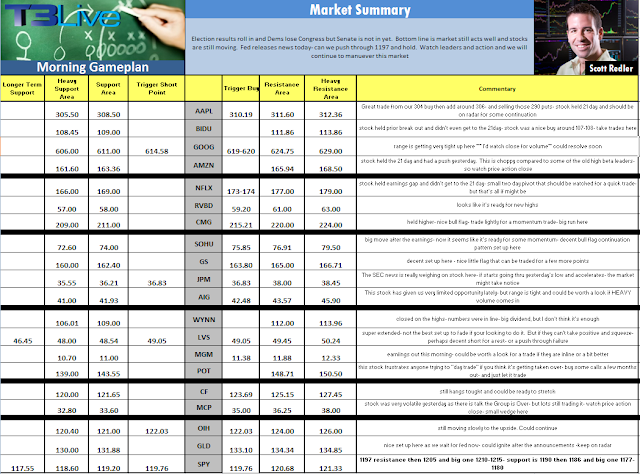

If you want individual stock levels, take a look at the price point sheet with comments, shared today on the blog for free. Stocks on the price point sheet today are:

Apple Inc. (Nasdaq:AAPL)

Baidu.com, Inc. (Nasdaq:BIDU)

Google Inc. (Nasdaq:GOOG)

Amazon.com, Inc. (Nasdaq:AMZN)

Riverbed Technology, Inc. (Nasdaq:RVBD)

Sohu.com Inc. (Nasdaq:SOHU)

Goldmans Sachs Group Inc. (NYSE:GS)

JP Morgan Chase & Co. (NYSE:JPM)

American International Group, Inc. (NYSE:AIG)

Wynn Resorts, Limited (Nasdaq:WYNN)

Las Vegas Sands Corp (NYSE:LVS)

MGM Resorts International (NYSE:MGM)

Potash Corp of Saskatchewan (NYSE:POT)

CF Industries Holdings (NYSE:CF)

Molycorp, Inc. (NYSE:MCP)

Oil Service HOLDRs (ETF) (NYSE:OIH)

SPDR Gold Trust (ETF) (NYSE:GLD)

SPDR S&P 500 (ETF) (NYSE:SPY)