September Corn closed up 7 1/4-cents at 3.39 1/2.September corn closed higher on Friday as it extended Thursday’s breakout above the 20-day moving average crossing at 3.25. If September extends this week’s rally, the reaction high crossing at 3.42 1/4 is the next upside target. A close above 3.42 1/4 is needed to trigger additional short covering and attract fresh buying interest. Stochastics and the RSI remain bullish signaling that sideways to higher prices are possible near-term. Today’s high-range close sets the stage for a steady to higher opening on Monday. Closes below Thursday’s gap crossing at 3.21 1/4 would temper the near-term friendly outlook in the market. As we move into August the market will be closely watching the August crop report, which will include an updated acreage report for near-term direction. The slow maturity of this year’s crop will make traders very nervous about any threat to an early frost this year. First resistance is today’s high crossing at 3.39 3/4. Second resistance is the reaction high crossing at 3.42 1/4. First support is the 20-day moving average crossing at 3.25. Second support is Thursday’s gap crossing at 3.21 1/4.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

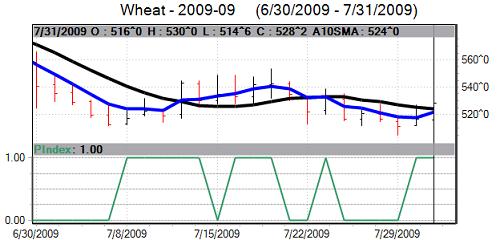

September wheat closed up 12-cents at 5.28 1/4. September wheat closed higher on Friday and above the 10-day moving average crossing at 5.23 3/4. The high-range close sets the stage for a steady to higher opening on Monday. Stochastics and the RSI are diverging and are turning bullish signaling that sideways to higher prices are possible near-term. Closes above gap resistance crossing at 5.54 are needed to confirm that a short-term low has been posted. If September extends this summer’s decline, psychological support crossing at 5.00 is the next downside target. First resistance is today’s high crossing at 5.30. Second

resistance is the reaction high crossing at 5.53. First support is Wednesday’s low crossing at 5.05. Second support is psychological support crossing at 5.00.

September Kansas City Wheat closed up 9 3/4-cents at 5.59 1/4. September Kansas City Wheat closed higher on Friday and above the 20-day moving average crossing at 5.56. The high-range close sets the stage for a steady to higher opening on Monday. Stochastics and the RSI are diverging but are turning bullish signaling that sideways to higher prices are possible near-term. Closes above the June 30th gap crossing at 5.90 are needed to confirm that a short-term low has been posted. If September extends this summer’s decline, last December’s low crossing at 5.33 is the next downside target. First resistance is last Monday’s high crossing at 5.78. Second resistance is the June 30th gap crossing at 5.90. First support is Wednesday’s low crossing at 5.42. Second support is last December’s low crossing at 5.33.

September Minneapolis wheat closed up 5 1/2-cents at 6.05. September Minneapolis wheat closed higher on Friday due to short covering as it extends this week’s trading range. The mid-range close sets the stage for a steady to lower opening on Monday. Stochastics and the RSI have turned bullish signaling that sideways to higher prices are possible near-term. Closes above the reaction high crossing at 6.26 3/4 are needed to confirm that a short-term low has been posted. If September extends this summer’s decline, March’s low crossing at 5.82 1/2 is the next downside target. First resistance is today’s high crossing at 6.11 1/2. Second resistance is the reaction high crossing at 6.26 3/4. First support is last Wednesday’s low crossing at 5.88. Second support is March’s low crossing at 5.82 1/2.

September soybeans closed up 15-cents at 10.44. September soybeans closed higher on Friday as it extends the rally off this month’s low. Today’s high-range close sets the stage for a steady to higher opening on Monday. If September extends this week’s rally, the 62% retracement level of this summer’s decline crossing at 10.49 1/4 is the next upside target. Closes below the 10-day moving average crossing at 9.71 would confirm that a short-term top has been posted. First resistance is today’s high crossing at 10.44. Second resistance is the 62% retracement level of this summer’s decline crossing near 10.49 1/4. First support is Thursday’s gap crossing at 9.67 1/2. Second support is the 20-day moving average

crossing at 9.65 1/2.

September soybean meal closed up $7.20 at $332.50. September soybean meal gapped up and closed higher on Friday as it extends the rally off this month’s low. The high-range close sets the stage for a steady to higher opening on Monday. Stochastics and the RSI remain bullish signaling that sideways to higher prices are possible near-term. If September extends this week’s rally, the 62% retracement level of this summer’s decline crossing at 336.40 is the next upside target. Closes below the 10-day moving average crossing at 305.20 are needed to confirm that a top has been posted. First resistance is today’s high crossing at 332.50. Second resistance is the 62% retracement level of this summer’s decline crossing at 336.40. First support is the 20-day moving average crossing at 308.30. Second support is Thursday’s gap crossing at 307.90.

September soybean oil closed up 11 pts. at 35.24. September soybean oil closed higher on Friday as it extends this week’s rally. The high-range close sets the stage for a steady to higher opening on Monday. Stochastics and the RSI are turning bullish signaling that sideways to higher prices are possible near-term. If September extends this month’s rally, the reaction high crossing at 37.20 is the next upside target. First resistance is Thursday’s high crossing at 35.37. Second resistance is last week’s high crossing at 35.50. First support is Thursday’s low crossing at 34.12. Second support is Wednesday’s low crossing at 33.25.