$7.88 3/4 —- the contract high

$7.36 3/4 —- 10-day moving average

$7.47 3/4 —- 20-day moving average

$7.23 1/2 —- 40-day moving average

$3.74 1/2 —- the contract low

July Chicago SRW wheat on Friday closed firmer and near mid-range. Prices hit a fresh six-week low early on. The bulls have faded badly and need to show power soon. Bulls’ next upside price breakout objective is to push and close Chicago SRW prices above major psychological resistance at $8.00 a bushel. The next downside price breakout objective for the wheat futures bears is pushing and closing prices below solid technical support at the March low of $6.91. First resistance is seen at $7.66 and then at Friday’s high of $7.78 1/2. First support lies at $7.48 1/2 and then at Friday’s low of $7.40.

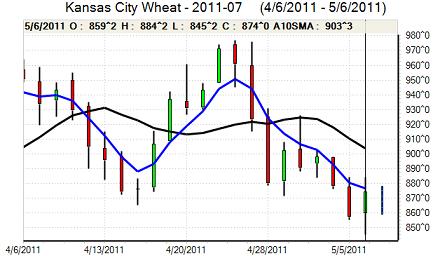

$9.50 3/4 — the contract high

$7.97 ——- 10-day moving average

$8.02 3/4 — 20-day moving average

$7.86 ——- 40-day moving average

$5.40 ——- the contract low

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

July K.C. HRW wheat on Friday closed higher and near the session high after hitting a fresh six-week low early on. Prices also scored a bullish “outside day” up on the daily bar chart. Bulls have faded and need to show more power soon. Bulls’ next upside price breakout objective is pushing and closing prices above major psychological resistance at $9.00. The bears’ next downside breakout objective is pushing and closing prices below major psychological support at $8.00. First resistance is seen at Friday’s high of $8.78 1/2 and then at $8.90. First support is seen at $8.60 and then at Friday’s low of $8.52 1/2.

$10.09 1/4 — the contract high

$9.03 1/2 —- 10-day moving average

$9.08 3/4 —- 20-day moving average

$8.91 1/4 —- 40-day moving average

$5.29 1/2 — the contract low

$14.74 1/2 — the contract high

$13.67 1/2 — 10-day moving average

$13.64 3/4 — 20-day moving average

$13.65 1/4 — 40-day moving average

$8.53 ——– the contract low

July soybean meal on Friday closed firmer and nearer the session high. Bulls have fading recently. Prices Friday hit a fresh three-week low. The next upside price breakout objective for the bulls is to produce a close above solid technical resistance at $360.00. The next downside price breakout objective for the bears is pushing and closing prices blow solid technical support at the April low of $343.00. First resistance comes in at Friday’s high of $352.20 and then at $355.00. First support is seen at $347.50 and then at $345.00.

$394.00 — contract high

$357.70 — 10-day moving average

$355.60 — 20-day moving average

$358.70 — 40-day moving average

$253.30 — the contract low

July bean oil on Friday closed weaker, near mid-range and closed at a bearish weekly low close. Prices also hit a fresh six-week low. Prices are in a four-week-old downtrend on the daily bar chart. The next upside price breakout objective for the bean oil bulls is pushing and closing prices above solid technical resistance at 58.00 cents. Bean oil bears’ next downside technical price breakout objective is pushing and closing prices below solid technical support at the February low of 54.53 cents. First resistance is seen at 56.00 cents and then at 56.50 cents. First support is seen at 55.00 cents and then at Friday’s low of 54.85 cents.

61.02 — the contract high

57.63 — 10-day moving average

58.04 — 20-day moving average

57.58 — 40-day moving average

37.95 — the contract low