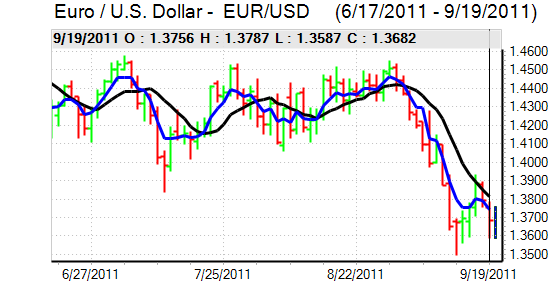

EUR/USD

The Euro found support below 1.36 against the dollar on Monday and attempted to regain some ground, but rallies continued to attract selling pressure as underlying Euro sentiment remained extremely weak.

Greece remained an important focus of attention as the government held talks with the IMF-led Troika. Following the conference call, the Finance Ministry stated that the talks had been satisfying while admitting that Greece had not met some of the targets and recognising that more would be needed to be done.

There was evidence of divisions within the cabinet over economic policies while the government also floated the possibility of a referendum on Euro-zone membership in order to strengthen the government’s mandate. The government will still find it extremely difficult to galvanize support for fresh austerity measures given the degree of popular resentment and there were very strong expectations of an eventual default.

The Euro was undermined further by a downgrading of Italy’s credit rating as underlying tensions increased. There were also major fears that Europe was on the verge of a major banking crisis. There were reports that some Chinese banks were cutting swap lines with European banks.

The US NAHB housing-sector index remained weak at 14 from 15 previously, although the impact was limited. There was further speculation over the Federal Reserve meeting on Wednesday. There were expectations that the Fed would deploy ‘operation twist’, designed to lower long-term interest rates and there was also some speculation that there would be more aggressive action by the central bank.

The Euro rallied to a high around 1.37 following the Greek troika talks before sliding back to the 1.36 area. The dollar continued to gain significant defensive support, especially with emerging markets subjected to heavy selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to move back above the 77 level against the yen on Monday and dipped sharply during the US session with lows near 76.30 before a partial correction as the Euro also dipped to 10-year lows just below 104.

Fears over the global economy and a deterioration in risk appetite continued to boost demand for the Japanese yen on defensive grounds, especially with fears surrounding the European banking sector which will increase the risk of capital repatriation from Europe.

The government launched an interim report on easing fears surrounding the strong yen including potential employment subsidies. There will be a discussion of further measures to support the economy at G20 meetings later this week and there was some further speculation over intervention.

Sterling

Sterling hit resistance close to 1.5750 against the dollar on Monday and dipped sharply weaker in early New York trading with lows below 1.5650 before a tentative recovery. The UK currency was undermined by a general theme of risk aversion as Euro-zone fears intensified, especially as there was also selling pressure on UK banking stocks.

Domestically, there was a continuing lack of confidence in the economy with growth fears exacerbated by Euro-zone fears. There were further calls from Business Secretary Cable for the Bank of England to respond with a further easing of monetary policy. There will, therefore, be further speculation that there will be additional quantitative easing within the next few months.

In this context, the Bank of England minutes will be watched very closely on Wednesday for any hints that the bank was moving closer to fresh action at the September MPC meeting with Sterling back below 1.57 against the dollar on Tuesday while the Euro hit resistance around 0.8725.

Swiss franc

The Euro held steady against the franc on Monday with the National Bank continuing to protect the downside. The dollar was, therefore able to maintain a firm tone and pushed to a high near 0.8880 with support below the 0.88 level.

There have been some reports that Asian banks have cut swap lines with UBS following the trading scandal and there will be some further unease over the vast banking-sector liabilities which could destabilise the wider economy. There will still be the potential for defensive capital flows into Swiss institutions which will provide important franc protection.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

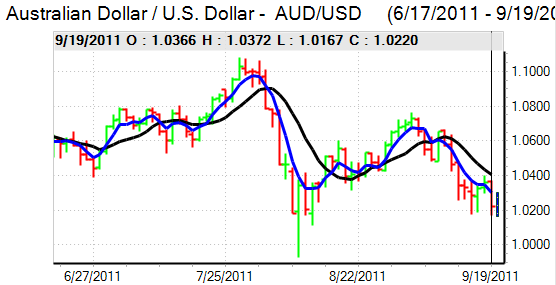

Australian dollar

The Australian dollar dipped to lows just below 1.0150 against the US currency in late US trading on Monday, the lowest reading sine early August before a recovery to the 1.02 area. A deterioration in risk appetite continued to undermine the currency as Euro-zone fears were compounded by expectations of weaker global growth.

The Reserve Bank did express growth doubts in the September policy minutes, although the bank was also uneasy over the medium-term outlook. In this environment, the bank was on hold and waiting for further domestic and international evidence. If there is further evidence of a downturn in the Asian economy, then the Australian dollar will be vulnerable to more sustained downward pressure.