EUR/USD

The Euro was unable to regain any significant ground on Monday and was subjected to renewed selling pressure as underlying confidence deteriorated. The focus was inevitably on Europe given that there was a US market holiday. A loss of support near 1.41 pushed the currency to lows below 1.4050.

There were further important stresses within the Euro-zone as Greek bond yields continued to rise with two-year rates rising to above 50% with further doubts whether the second bailout package would be ratified as tensions over budget plans and collateral continued. There were also increased tensions surrounding Italy as the government attempted to keep the austerity programme on track. There was strong international criticism of the decision last week to exclude some measures from the programme of reforms, while there was also an increase in domestic protests against the measures with a General Strike called for Tuesday.

Current ECB President Trichet and President-designate Draghi both called for immediate approval of the measures and warned that the ECB bond-buying programme was temporary.

The ECB announced that it had purchased EUR13.3bn in bonds in the latest reporting week from EUR6.7bn previously even though there was still an increase in yields. Benchmark Italian yields rose to above the 5.50% level with confidence also eroded by rumours of a credit-rating downgrade.

There were further stresses within the banking sector as the German Dax weakened to a two-year low while there was also a record amount of cash placed at the ECB and dollar Libor rates also continued to edge higher.

Although US markets were closed, there was a further decline in yields with 10-year yields at a 60-year low below 2.0% as defensive demand for US Treasuries continued. The Euro remained on the defensive in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar and yen were again confined to narrow ranges during Monday with the US currency unable to break above the 77 level. Both currencies continued to gain support as risk appetite continued to deteriorate and there was a flow of funds into defensive currencies.

The government pushed for more Bank of Japan support for the economy and there will be pressure for the central bank to take additional action at Wednesday’s monetary policy meeting even though the effectiveness is likely to be limited.

The international developments will continue to be extremely important in the short term and there will be further defensive yen support if confidence in the global economy continues to deteriorate. The dollar was capped below 77 on Tuesday as exporter selling increased on any significant US gains.

Sterling

Sterling weakened ahead of Monday’s data with rumours of a weak figure. In the event, the UK PMI services-sector index fell very sharply to 51.1 for August from 55.4 the previous month. This was the sharpest decline for over 10 years and the lowest reading since the weather-induced dip to below 50 in December 2010.

There was a sharp deterioration in confidence and employment levels also continued to decline. The latest BRC retail sales report was also weak with a 0.6% decline in the year to August from a 0.6% gain previously.

The PMI data will reinforce fears over a further deterioration in economic conditions. There will also be further speculation over additional quantitative easing by the Bank of England which will tend to sap Sterling support and there will be some speculation that there will be action at this Thursday’s policy meeting. Sterling will also tend to be vulnerable when risk appetite deteriorates and Sterling tested support below 1.61 against the dollar.

Swiss franc

The franc maintained a strong tone on Monday with the US dollar blocked close to the 0.79 level and there was a test of support near the 0.7820 region. The Euro also weakened to test support near 1.10 against the franc before finding some relief.

Fears surrounding the Euro-zone economy and financial sector continued to provide defensive support for the Swiss currency as European financial stocks came under heavy selling pressure.

The Swiss Bankers Association stated that a temporary franc peg to the Euro could be justified and there will be speculation over additional National Bank action if the franc strengthens further.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

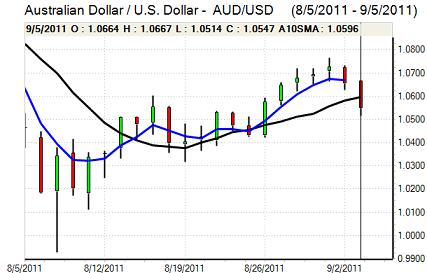

The Australian dollar hit resistance close to the 1.06 level against the US dollar on Monday and dipped sharply lower during the European session in choppy trading conditions. The currency was undermined by a further deterioration in risk appetite and fears over the global growth conditions.

The Reserve Bank of Australia left interest rates on hold at 4.75% following the latest monetary meeting. The statement expressed increased doubts over the near-term growth outlook, but also maintained an optimistic stance towards the longer-term outlook. This optimism helped the currency find support in the 1.05 area as markets were expecting a dovish tone from the bank.