EUR/USD

The Euro was unable to regain ground during the European session on Tuesday and dipped to lows in the 1.3025 area against the US dollar ahead of the US open.

Greek discussions continued to dominate markets as the government attempted to reach an agreement on fresh austerity measures. Officials have already admitted that the second financing package will now probably need to be at least EUR145bn from EUR130bn previously. The troika has insisted that the Greek government will need to make fresh austerity measures to reach agreement and if they fail then there will be a high risk of a destabilising default.

There was no agreement during Monday with Greek officials denying that there was a formal deadline and further intense debate within political parties. With no agreement on Monday, talks will continue to Tuesday with uncertainty a major feature. The Euro regained some ground during the New York session as markets became slightly more confident. The logic is that an uncontrolled default would have extremely serious consequences for Greece and the Euro area as a whole and will, therefore, be avoided at all cost, but this logic could be severely tested given domestic opposition to further austerity measures.

The Euro-zone data provided some degree of relief with the Sentix investor confidence index rising to -11.1 for January from -21.1 previously.

There were no major US developments during the day, although a speech from regional president Bullard did attract attention. He repeated his concerns over a zero interest rate policy and was also opposed to further quantitative easing. The underlying shift in FOMC thinking is illustrated by the fact that Bullard was until recently generally considered dovish while his views now are significantly more hawkish that the majority FOMC position.

The Euro rallied back to the 1.3120 area with some frustration that it did not break below 1.30 triggering some short covering and tensions will remain high given the possibility of a relief rally if there is a Greek deal.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was confined to narrow ranges during Monday with some support on dips back to the 76.50 area. Although the US currency received support from the US employment data, underlying yields are still not conducive to a stronger US currency.

The latest quarterly Japanese intervention report indicated that Japan intervened covertly as well as openly during the fourth quarter with several days when they intervened without any official announcement of action. There will be further pressure on the Bank of Japan to intervene and prevent renewed yen appreciation. There would be US opposition which will encourage further covert action, although its doubtful whether this would have much market impact without a shift in fundamentals.

Sterling

Sterling found support on dips to below 1.5750 against the dollar on Monday and rallied back to test resistance above 1.58 as wider Euro moves tended to dominate with the Euro struggling to regain the 0.83 level.

The latest economic data was mixed with the Halifax house-price index recording a 0.6% increase for January. The BRC retail sales index reported a 0.3% decline in retail sales in the year to January following a 2.2% increase the previous month.

Debate surrounding the Bank of England policy this week will continue to be an important focus ahead of Thursday’s meeting. Market expectations of further quantitative easing have been scaled back following the recent PMI data which is continuing to provide some degree of support for the UK currency with Sterling above 1.58 in Asia on Tuesday.

Swiss franc

The dollar pushed to highs just above 0.9250 against the franc on Tuesday, but it was unable to sustain the gains and dipped back to lows around 0.9180 during the US session. The Swiss currency was stuck near the 1.2060 area during the day.

The 1.20 minimum level will remain an important focus with National Bank reserves data due during the day. Acting-Chairman Jordan will also be making a speech in which references to the currency level will be watched extremely closely, especially given market doubts over the bank’s commitment to the minimum level following Hildebrand’s departure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

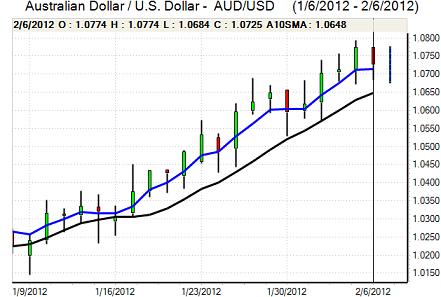

The Australian dollar dipped to test support near 1.0680 against the US currency on Monday and secured strong support close to this level with a move back to the 1.0740 area as the US currency failed to secure sustain support.

There was inevitable caution ahead of the Reserve Bank interest rate decision and there was an unexpected outcome with the bank leaving rates on hold at 4.25% rather than cutting by a further 0.25%. The bank was more optimistic surrounding the international growth outlook which encouraged the bank to keep rates on hold. The Australian dollar spiked higher to a six-month peak close to 1.08 against the US dollar following the decision.