EUR/USD

The market situation was little changed in early Europe on Friday with the Euro able to maintain a slightly firmer tone, but struggling to make much headway as underlying sentiment was still very fragile.

The Greek situation remained a key market focus during the day. Early in the US session there were market rumours of a fresh agreement over Greek debt which pushed the Euro stronger. There was speculation that there would be an agreement to let Greece borrow at more favourable rates than determined by markets which would ease the debt-financing burden.

Later in New York, Fitch announced that it had cut Greece’s credit rating by two notches to BBB- and maintained a negative outlook on the rating. The announcement triggered a spike weaker for the Euro, but it recovered to make fresh highs later in the session.

There is likely to have been a significant covering of short positions ahead of the weekend which helped underpin the Euro. Underlying sentiment is still liable to be very fragile and it will be difficult to secure sustained relief.

There were no significant US economic data releases during the day and the US currency was unable to secure wider support. With the US trade-weighted index under some pressure, the Euro pushed to a high around 1.3495.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Asian equity markets were generally strong on Friday with bourses testing 22-month highs and this dampened demand for the yen. Investors were reluctant to sell the yen aggressively during Friday given the possibility of a near-term move to adjust the Chinese yuan regime. Speculation over a revaluation is likely to remain an important market feature.

Exporter selling is also likely to remain a feature when the dollar pushes towards the 94 area with the US currency close to 93.50 in early Europe as the yen struggled for direction.

The dollar was unable to make significant headway during the day and it dipped to lows near 93.10 on wider selling. The Euro found support below 125 against the Japanese currency and strengthened to highs near 125.80.

Sterling

Sterling was able to maintain a steady tone in early Europe on Friday as there was no repeat of the selling seen over recent European sessions.

The latest producer prices data was stronger than expected with a particular focus on input costs. A combination of rising energy prices and Sterling weakness triggered a 3.6% increase in prices for March to give an annual increase of 10.1%. Output prices were more measured, but there was still a 5% annual increase and there will be some unease over the situation within the Bank of England.

There will be some speculation that the bank may have to tighten policy earlier than expected to keep prices under control and this may provide some Sterling support.

Risk appetite was generally robust during the day which helped underpin Sterling and it pushed to a high near 1.54 against the dollar.

Swiss franc

The dollar pushed to a high around 1.0760 against the franc on Friday before weakening to lows near 1.0655 in US trading. The Euro managed to secure a recovery against the Swiss currency with a high near 1.5380.

There were further reports of National Bank intervention to weaken the currency with the bank as usual not making any comments on the reports.

The franc may also lose some support if there is a sustained improvement in Euro sentiment, but underlying confidence is liable to remain fragile which should limit losses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

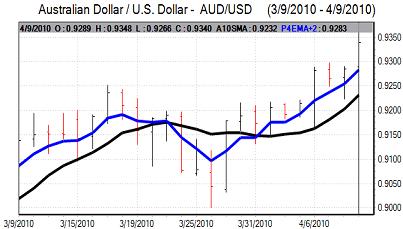

Australian dollar

The Australian dollar continued to gain from improved risk appetite in Asian trading on Friday and challenged levels around the 0.93 level. There was further confidence surrounding the Australian economy and this will continue to underpin the currency in the near term.

As the US currency came under some selling pressure, the Australian dollar pushed to a high near 0.9340. There will still be some unease over the implications of any further monetary tightening by the Chinese central bank.