EUR/USD

The Euro found support below 1.43 against the dollar during Monday and had a slightly firmer tone in choppy trading conditions as there was a peak in the 1.4425 area. Risk conditions remained slightly firmer following sharp dip in sentiment last week and this also curbed selling pressure on the Euro.

Situation surrounding the Greek situation remained an important focus with a further series of market rumours during the day. The situation remains tense, especially with increased expectations that Greece would not be able to regain market access during 2012. There were media reports that there would be an additional EUR60bn support package for Greece, but these reports were denied by the Greek government.

There were also reports from within the German government that Greece may not qualify for the next loan tranche under the existing agreement given doubts over progress surrounding fiscal adjustment. There will be further important stresses within the German government with demands for tougher conditions in order to provide additional support. Uncertainty will remain a key short-term feature and is also liable to trigger further volatility, especially given the potential contagion risk surrounding other Euro members.

There were no major US economic releases during the day and markets continued to focus on the shape of monetary policy following the scheduled end of the Federal Reserve’s quantitative easing programme at the end of June. There will be further speculation that commodity prices will find it more difficult to make headway which will also tend to curb selling pressure on the US currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was able to resist further selling pressure on Tuesday and there was a generally firmer tone during the day with a peak just above the 81 level as the Japanese currency also lost ground on the crosses.

An improvement in risk appetite curbed defensive demand for the yen with fresh speculation over renewed interest in carry trades funded through the Japanese currency.

Longer-term capital flows also remained the focus of attention with contradictory expectations of future trends. There were expectations of flows out of Japan once the US quantitative easing programme finishes, but there was also unease over potential capital repatriation back to Japan following march’s earthquake. The dollar consolidated just below 81 in Asia on Wednesday.

Sterling

Sterling was unable to break above 1.6420 against the dollar on Tuesday and drifted weaker to lows around 1.6320 before a tentative recovery. The UK currency also lost ground on the crosses with a retreat to the 0.88 area against the Euro.

There was further caution surrounding Wednesday’s Bank of England inflation report with expectations that the central bank would lower its growth forecasts and cast fresh doubts over the potential for an early increase in interest rates which would tend to undermine Sterling sentiment.

There was also some further uncertainty on political grounds which unsettled the currency, although the impact was measured at this stage. The UK drifted weaker again in Asia on Wednesday with a retreat to the 1.6320 area.

Swiss franc

The dollar found support close to 0.8730 against the Swiss currency on Tuesday and spiked higher following the inflation data with a peak near the 0.88 level. After a partial retreat, the US dollar pushed higher again during the Asian session on Wednesday with the Euro weakening to lows near 1.27.

The latest Swiss inflation data was significantly weaker than expected with a 0.1% increase in consumer prices for April compared with expectations of a 0.5% gain for the month. The weaker than expected data will lessen immediate pressure for the National Bank to increase interest rates in the short term.

The franc will lose some defensive support if there is a sustained improvement in risk appetite, although there will still be a high degree of caution over the Euro-zone outlook.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

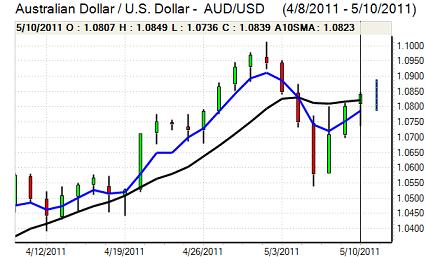

Australian dollar

The Australian dollar found support on dips to the 1.0750 area on Tuesday and a break of resistance in the 1.08 area pushed the currency to a peak above the 1.0850 level in local trading on Wednesday.

There was a stabilisation in risk conditions and a rally in commodity prices which supported the Australian currency following the sharp retreat seen last week while the government’s 2011/12 budget was also generally well received which underpinned market sentiment.

Volatility will remain an important risk in the short term, especially with a further tightening of margin requirements on commodity trading.