EUR/USD

The Euro found support below 1.41 against the dollar during Monday and advanced during the US session with a peak close to 1.4250. There was technical support for the currency given that it was over-sold following sharp losses over the previous week and there was also evidence of bargain hunting on approach to the 1.40 level.

The Euro-zone inflation rate was confirmed at 2.8% for April and there will be further speculation that the ECB will look to increase interest rates again within the next few months to combat inflation pressures and this underpinned yield support.

At the Euro-group meeting, Euro leaders approved Portugal’s bailout package and stated that the Greek situation will be monitored closely. There were hints that a Greek debt re-profiling could be considered over the next few months and German Chancellor Merkel also stated that a debt re-scheduling should be avoided as it would be extremely damaging.

Nevertheless, there I still a high degree of uncertainty over the Greek situation, especially with major uncertainties over the IMF situation. Any new leader from outside Europe could take a less sympathetic attitude towards Euro-zone difficulties.

The latest New York manufacturing index fell to 11.9 for May from 21.7 previously awhile the NAHB index remained stuck at a depressed level of 16. There will be further doubts surrounding the US and global economy, especially with fresh concerns over the Chinese economic outlook. There will, therefore, be the risk of renewed selling pressure on commodities which would tend to support the US dollar. The latest TIC flows recorded net long-term inflows of US$24bn for March as China continued to curb its holding of US Treasuries. The Euro fluctuated around 1.4150 in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found solid support on dips to the 80.70 area against the US yen during Monday and rallied to a high around 81.20 in Asian trading on Tuesday. The cross-market trends were important with the yen undermined by a significant correction weaker against the Euro.

Bank of Japan Governor Shirakawa stated that the economy is in a severe state following the March earthquake and the central bank will retain an extremely loose monetary policy at this week’s meeting. Underlying confidence in the economy will also remain weak which will undermine confidence in the yen.

Risk conditions will continue to be watched closely and the yen will gain some support from any further downward pressure on commodity prices, especially if fears over the Chinese economy increase.

Sterling

Sterling advanced to highs around 1.6250 against the dollar on Monday, in tandem with a general weakening of the US currency, but it was unable to sustain the advance and retreated back to test support below 1.62.

Underlying confidence in the economy remains weak with strong expectations that consumer spending will continue to weaken, especially after a gloomy set of independent forecasts. The latest consumer inflation data will be released on Tuesday, but there will be serious doubts whether the Bank of England would be able to respond to a higher than expected rate and this would tend to limit Sterling support. There will also be increased fears that the government’s budget targets will not be met.

The UK currency still gained protection from a lack of confidence in the other major currencies with the Euro undermined by debt woes while the US is embroiled in the debt limit debate.

Swiss franc

The dollar hit resistance close to 0.8940 against the franc on Monday and retreated sharply to lows near 0.88 before stabilising near close to the middle of this range. Although the Euro managed to stabilise against the dollar, the currency had a weaker tone on the crosses with a slide to lows near 1.2510 against the Swiss currency.

There will be greater doubts over the global economic outlook and this is likely to provide support for the franc, especially with the currency still benefitting from underlying fears over the Euro-zone economy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

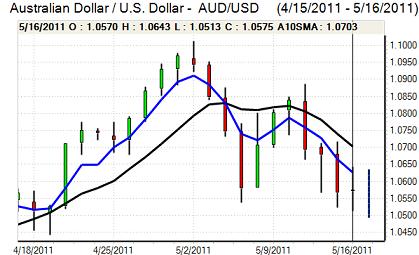

Australian dollar

The Australian dollar found support close to 1.0520 against the US dollar in Europe on Monday and rallied to a high around 1.0640 before being subjected to renewed selling pressure in choppy trading conditions. The currency was unsettled by renewed declines in commodity prices and there will be further damage if fears over the wider Asian economy increase.

The Reserve Bank of Australia minutes from May’s meeting again stated that interest rates would probably need to increase again, but the minutes also acknowledged that the strong currency was having a beneficial impact on inflation.