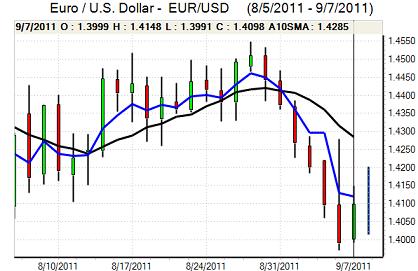

EUR/USD

The Euro found support in the 1.40 area against the dollar during Wednesday and briefly spiked to the 1.4150 area before faltering again.

The German Constitutional Court ruled that the original May 2010 Greek bailout was not illegal under the constitution which provided some immediate relief to the Euro, although the decision had been expected. The court also had important reservations and demanded that parliament should be given greater control and influence over the budget and bailouts.

The Italian Senate approved the amended austerity plan in the Senate and the debate will now move to the Lower House with tensions still high. Greek yields failed to decline significantly over the day amid further concerns over the lack of progress on austerity measures. The German CSU parliamentary leader warned that a Greek exit from the Euro could not be ruled out, although he hoped that Greece would follow its austerity plans. There was further uncertainty over the next loan tranche with Germany insisting that a favourable troika report was required.

The ECB interest rate decision and Press Conference will be watched extremely closely on Thursday and there will be strong pressure for the bank to take a more dovish stance. The comments on the ECB peripheral bond buying programme will also be watched extremely closely amid fears over further divisions within the bank.

The US Federal Reserve Beige Book stated that growth was subdued with important areas of vulnerability and there will be further pressure on President Obama’s job package due to be announced later on Thursday. There will be further pressure for the Federal Reserve to take further action.

There will be caution ahead of Friday’s G7 meeting and there will be speculation that there could be concerted intervention or further policy co-ordination.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 77 area against the yen during Wednesday and edged higher to the 77.35 area during the day. The yen and dollar continued to move in tandem with each other and there was a cautious improvement in risk appetite which dampened demand for both to some extent.

There was further exporter dollar selling which prevented the US currency making much headway, although selling levels appeared to have been moved higher.

The dollar is still in a poor position to gain independent support on yield grounds. There will be further speculation that the Japanese authorities will take further action to weaken the yen and the G7 meetings starting on Friday will be an important focus.

Sterling

Sterling was unable to sustain a move above the 1.60 level against the dollar on Wednesday and drifted lower during with a test of support near 1.5910 before consolidating with evidence that a prominent central bank had been selling the currency above the 1.60 level

The latest UK data did little to improve sentiment towards the economy or currency with a weaker than expected industrial production reading for July with a 0.2% monthly decline. The latest NIESR GDP estimate also showed a sharp slowdown in August to 0.2% from 0.6% previously which dampened expectations of a third-quarter recovery and maintained underlying fears surrounding the economy.

The Bank of England will announce its interest rate decision on Thursday with no real prospect of a change in interest rates. There was, however, speculation that the MPC could sanction additional quantitative easing which also tended to keep the UK currency on the defensive. A decision to keep policy steady could provide temporary Sterling relief.

Swiss franc

The dollar hit resistance above 0.86 against the franc on Wednesday while there was support below the 0.8550 level in a much calmer session that the previous day. The Euro comfortably held above the 1.20 National Bank threshold against the Swiss currency.

There was a slight easing of risk aversion during the day which lessened buying support for the franc with markets still looking to adjust after the bank’s decision to set a minimum Euro rate. At this stage, there was a further reluctance to engage in combat with the central bank. Underlying confidence in the Euro-zone was extremely fragile and any ECB switch to a more accommodative policy would increase potential pressure on the National Bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

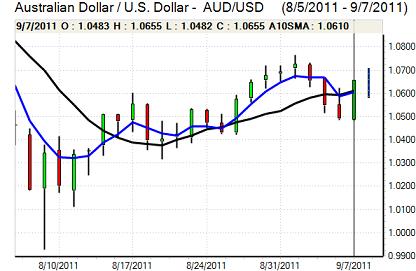

Australian dollar

The Australian dollar maintained a firmer tone on Wednesday and pushed to a high above 1.0650 against the US currency on a slight improvement in risk appetite and yield support for the Australian currency.

The latest employment data was significantly weaker than expected with the unemployment rate rising to 5.3% from 5.1% while there was a 9,700 decline in employment for the month after a revised 4,100 decline the previous month. There were fresh concerns over the economic outlook which put downward pressure on the Australian dollar with a retreat to 1.0580, although it was still broadly resilient.