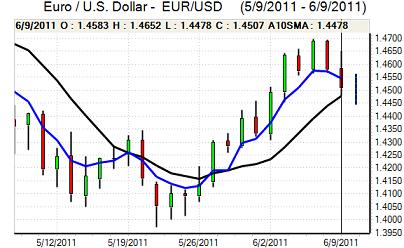

EUR/USD

After trading in a 1.46-1.4650 range ahead of the ECB interest rate decision on Thursday there was little reaction to the expected decision to hold interest rates at 1.25%. The Euro spiked higher at the start of the press conference before retreating sharply.

Bank President Trichet stated that strong vigilance was required on inflation and this suggested that the bank would increase interest rates in July. He was careful not to pre-commit on rate decisions and was also cautious over the outlook which suggested that the ECB could decide not to tighten beyond July.

The bank maintained extraordinary liquidity measures which maintained structural fears over the Euro-zone economy. The Greek situation was monitored closely during the day and there was further unease over the situation, especially with growing conflict between the central bank and German government. A sharp downward revision to the latest Greek GDP data also undermined confidence in the Euro as it illustrated the depths of the structural problems.

The German government wants private bondholders to share the burden of debt restructuring while the ECB remains strongly opposed to any form of restructuring, especially as it would undermine the bank’s balance sheet. There was aggressive Euro profit taking, especially as uncertainty remained extremely high.

The US jobless claims data was slightly worse than expected with a marginal increase to 427,000 in the latest week from 426,000 previously while the trade data was better than expected with a decline in the surplus to US$43.6bn for May from US$46.8bn previously.

There was still a more cautious attitude towards risk which helped underpin the US currency even though the underlying fundamentals remained weak. The Euro dipped to lows just below 1.4480 before stabilising in the 1.45 region.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 80 against the yen during Thursday and moved higher to the 80.45 area later in the US session. The US currency gained some support from a lower US trade deficit as exports rose strongly for the month.

There was some stabilisation in risk appetite during the US session as stocks recorded their first daily advance for June and this also curbed immediate yen demand with evidence of institutional dollar demand close to the 80 level.

The dollar was unable to break above 80.50 and dipped again in Asian trading on Friday. A slightly narrower than expected Chinese trade surplus supported the yen, although the general mood of caution surrounding the global economy and low US yields were the primary market drivers.

Sterling

Sterling edged weaker against the dollar ahead of the Bank of England interest rate decision on Thursday with no real expectations of a policy move by the central bank.

There were no surprises from the decision as interest rates were left on hold at 0.50% while there was no change to the GBP200bn quantitative easing amount. There was no statement following the decision and the vote split will not be known until the minutes are released later in the month.

There was further uncertainty surrounding the UK growth outlook and the general tone was pessimistic. Although there was a lower than expected trade deficit of GBP7.4bn for April, there was still little in the way of expectations that the economy can secure strong growth through rising exports given unease over global growth trends.

The UK currency weakened to the 1.6360 area against the dollar, but did gain some protection from a Euro decline towards 0.8850 on the crosses.

Swiss franc

The dollar spiked higher against the franc during the European session on Thursday with a move to the 0.84 area and pushed higher again with a peak near 0.8450 following the ECB press conference before consolidation just above 0.84.

The Euro pushed to a peak near 1.23 on expectations of a tough ECB stance, but then weakened back to the 1.22 area as there were further uncertainties surrounding the Greek debt situation.

The Euro also failed to sustain support on strong suggestion that interest rates would be increased in July as risk conditions tended to dominate with the franc still gaining underlying support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support below 1.0580 against the US dollar during Thursday and then rallied back to the 1.0640 area even though the Euro was subjected to wider selling pressure. There was a stabilisation in risk appetite which helped underpin the Australian currency as Wall Street gained ground.

There was still a lack of confidence in the domestic economy which undermined demand for the Australian currency and media coverage was also cautious surrounding the currency as global growth fears increased and the local currency was generally on the defensive in Asia on Friday.