By: Scott Redler

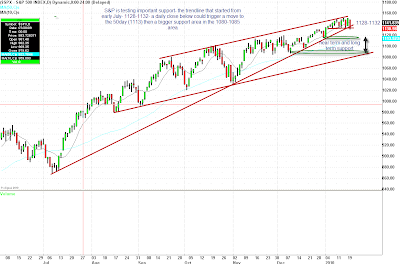

The uptrend that’s been in place since July was tested yesterday, and held for the time being. The level to watch closely is in the 1,128-1,132 range. Watch for a 60 minute or daily close below that level for some more pressure to come into the market. I have inserted a chart today highlighting the important levels in the S&P.

You still can’t “short lows” or trade from a net short position, but if you have not done so already, it’s time to clean up some long positions and get very flexible while this uptrend is getting tested for the first time in 2010.

Goldman Sachs (GS) reported a earnings numbers, on somewhat light revenues. Watch how it trades in the first hour for clues on the banks. Most bank earnings are now out and they were largely treated with a yawn. FAS looks good, but that could change quickly if GS doesn’t sustain its recent upmove and the rest of the group follows.

The Rundown:

- Commodities were under pressure with the Dollar’s move higher and the rhetoric out of China on curbing bank lending.

- Gold broke to the downside of its tight wedge and is testing its previous breakout. I might look for a morning bounce (just as a daytrade) to see if it shows its face.

- Tech continues to act poorly. Google (GOOG) reports after the bell today and will be a big influence on the market. It has come down and lost its 50-day and the fight with China is serious. Watch the post-report action.

- IBM got hit on a solid report, as did Intel (INTC).

- Apple (AAPL) is the only one really holding onto its strong technical pattern, but it’s getting erratic.

- Amazon (AMZN) is trying its best to hold $125.

- Research in motion (RIMM) is testing its 50-day.

I don’t see many long technical setups–couple that with the recent technical damage and three distribution days in 2 weeks and I am now VERY cautious. I am in 90% cash and am just trading intraday right now.

This action forced me to clean up my macro longs. If the S&P breaks its uptrend line and closes below that level, I will start trading from a NET SHORT position. I have been consistently NET LONG for almost a year, so such a change would be a big one.