The April collapse in gold has drawn attention to the two-year decline in the commodity sector. Since gold’s collapse both it and crude oil have experienced a strong rally over the last two weeks. Many want to know if commodities have bottomed.

Taking a look at the Continuous Commodity index (CCI) we can see that it has breached the 61.8% retracement of the June-September advance opening the door for a return to the low near 500. The trend momentum indicator, ADX, confirms the downtrend.

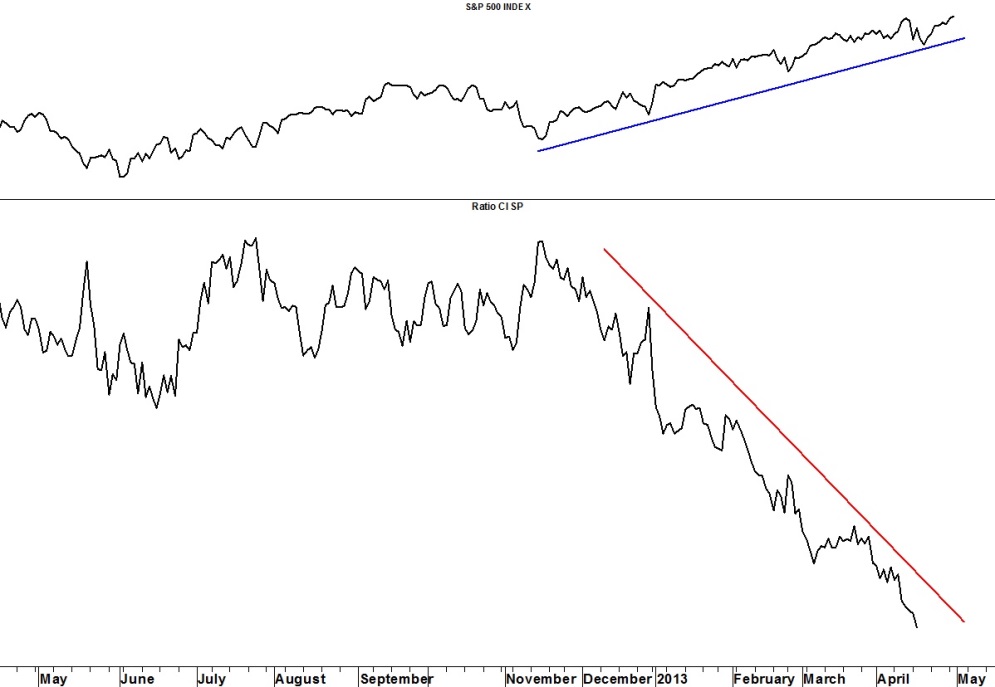

The ratio chart shows continuing severe under-performance of commodities versus equities (CCI/SPX) giving no reason to think that a low has been seen in commodities yet.

The daily (and weekly) Coppock Curve, if it continues to hold above the 2/27/13 low (as the index prints new lows), will constitute a positive divergence and imply a rally should be expected in commodities. A 71-Day cycle in the DJ UBS Commodity index shows an expected turn ideally on 5/15/13.

BOTTOM LINE?

The 5year cycle in the commodity index ideally points to a major low in December 2013. In the meantime, weekly cycles forecast an inflection point in the same index in mid to late July. Assuming a May low makes me expect the turn in late July to be a top.

= = =

For more information, take a “sneak-peek” at Seattle Technical Advisors.com