In this day and age of information overload scientists estimate that we get hit with a new piece of information every seven seconds on average. Okay, I just made that up, but here’s my point.

We are exposed to so much data at such a rapid pace that we rarely get a chance to fully process it, which ultimately causes our attention span to narrow dramatically.

It changes our mindset to one of “resolution now.” Of instant gratification. Conclusion before the commercial break, because we sure as heck can’t wait til next week’s episode.

MARKETS ARE DIFFERENT

But that’s not how the markets work. Despite the ADHD nature of day trading, the macro trends that move the broader averages still take time to work themselves out. However a large number of traders I’ve talked to lately lament the fact that the market, represented by the SPX, didn’t break into new highs in mid-August.

LOW VOLUME FLAG

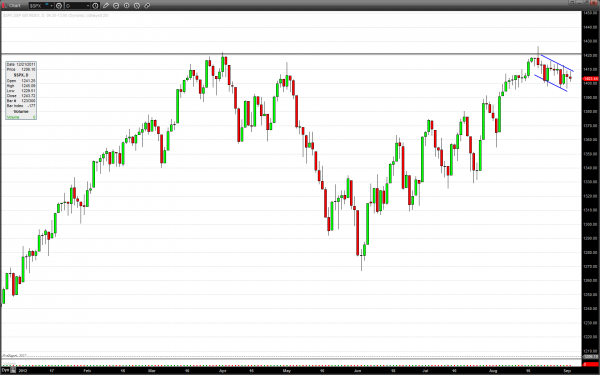

But it’s okay, because the market is doing what it is supposed to do. Flagging in a tight range, with low volume, below a resistance level that goes back to March of 2008 is healthy action.

IT JUST TAKES TIME

A break of the March highs straight up from the June lows would have most likely failed because there would not have been enough time to properly digest the move. It would have been even more suspect if broken during the traditionally slow summer months.

As long at the consolidation stays up at this level there will be no need to ring the warning bell. And it may in fact take until after the November elections until we get some resolution in the markets to the upside.

Until then have a warm glass of milk or some Adderall and just relax.

[Editor’s note: How do you wind down from the stress of trading?]