The catastrophic events unfolding in Japan caused by last week’s 9.0 earthquake led to the death of thousands, with many more missing. Mother-nature wreaked havoc on infrastructure, crippling Japan’s nuclear power plants; forcing millions to survive without electricity and manufacturers to close operations. Explosions and fires from structural damage, has exposed reactor cores at multiple plants. Japan is feverishly working to cool reactors to avoid the spreading of radiation.

Similar to the Deepwater Horizon oil spill from a year ago in the Gulf of Mexico, reports are already emerging from the United Nations and Japanese government that relaxed oversight and greed, contributed to this nuclear crisis. Active investors will have to navigate this crisis against a backdrop of constant news updates on spreading radiation contamination and negligence in building the reactors.

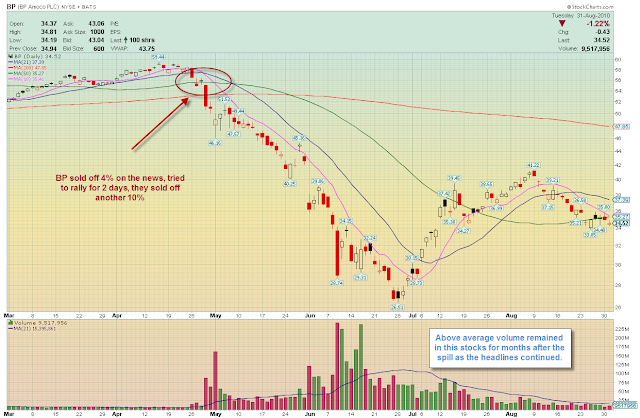

This can only result in massive headline

risk. The same headline risk that saw British Petroleum (NYSE: BP) lose over 50% of its value in 2-months, now weigh on General Electric (NYSE: GE) and Cameco Corp. (NYSE:CCJ)… GE designed the failing reactors and Cameco provided the nuclear material.

Governments across the globe will now think twice about increasing nuclear energy supply, affecting Cameco, a leading provider of uramium to nuclear power producers. When Japan

deals with the immediate crisis at hand, they will set their sights on GE.

Similarities between British Petroleum and Cameco are already emerging techni

cally on the charts…

This is not to suggest that Cameco and General Electric are automatic shorts for the next 2 months. However, active investors should be cognizant of the headwinds facing CCJ and GE, as technicals and fundamentals take a backseat to headline risk.

Traders should make a watch-list of

stocks most affected by the crisis in Japan and fol

low those stocks as the elevated volume remained in BP for months after the spill.

*DISCLOSURE: Short CCJ

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.