The energy market is an interesting one. It seems like a simple market to trade, but comes with a lot of volatility. When you trade crude oil, you have to be right about the price direction, as well as the timing. Trading products such as heating oil and gasoline allows traders to incorporate some seasonal strategies, including intermarket spreads, and be able to better weather some of that volatility.

Gasoline and heating oil prices are dictated by economic demand, and the seasonality of that demand. Summer driving season pushes gasoline prices higher, and winter heating season pushes heating oil higher. The refiners and the rate at which they produce the products at different times of the year also play an important role in the price discovery. They will sometimes under- or over-produce heating oil and/or gasoline depending on their input costs, at various times of the year.

When the bull run in energy starting gaining steam in 2007, heating oil traded at a premium to gasoline, and into 2008, the spread got wider and wider. When you look far back in time, it’s actually an unnatural relationship for heating oil to lead gasoline. Most of it was due to the fact that we had a strong economy. Heating oil includes distillates as well as diesel fuel, so when the economy is clicking at all cylinders, that helps explain heating oil’s premium over gasoline. Refining rates affect the price differentials between the two products. Generally speaking, gasoline would trade with a higher price than heating oil, and seasonal tendencies would effect the spread between the two products.

In the summer and fall 2008, gasoline and heating oil stocks were at record lows, which would help explain the high prices at that time. Prices were at record highs in the summer 2008, and despite low stocks, prices subsequently plummeted due to demand destruction.

Heating oil saw a significant drop from a high of about $4.15 per gallon in 2008 to a low of about $1.12 in March 2009, about a 70 percent drop.RBOB gasoline was also at an extreme high in 2008, rising to about $3.63 per gallon, then hitting a low under 80 cents in December.

Once heating oil started coming down in late 2008 and into 2009, the drop slowed as we hit winter demand season. Here are some statistics regarding these markets so you can see the price relationship.

June 30, 2008

RBOB $3.57 Heating oil $4.10

Heating oil premium 53 cents

December 22, 2008

ROB $0.84 (swing low) 76 percent drop; heating oil $1.24

Heating oil premium 40 cents

March 9, 2009

Heating oil $1.19 (swing low) 70 percent drop

RBOB $1.35

Gasoline premium 16 cents

Long March RBOB/Short Heating Oil

A lot of people want to participate in the energy markets, but the volatility makes it difficult. However, there are strategies you can pursue which require you to be right about price, without being as accurate in the timing. You can formulate a strategy based on capturing the premium between these two markets, whether the markets are going down or up. And, when you are in a spread, the volatility isn’t as extreme as a straight long or short position in either.

The spread between heating oil and gasoline has narrowed, and in my opinion, is out of sync with reality. I believe it will stay this way for some time, until perhaps the economy cranks up again. Heavy distillate and diesel fuel demand will make heating oil prices rise.

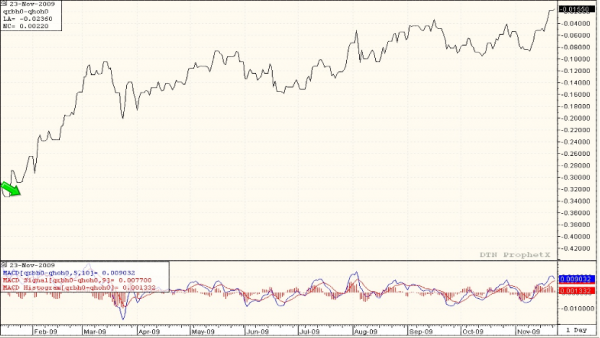

Because we have gasoline at a discount to heating oil, we see negative numbers on the chart, which narrows from about -30 cents in February 2009 to about -2 or -2 ½ cents at the present time. Gasoline has been catching up on heating oil, and in the spot market, they are almost the same price.

Typically, by November the industry has built sufficient starting inventories of heating oil and is operating at capacity to produce more. Refiners produce more oil in the summer and fall, preparing for demand that’s expected in the winter. Thus, supply is normally plentiful when consumption is building toward a peak. In fact, distributors and refiners aggressively liquidate supplies into the new calendar year in order to minimize inventory by the end of the heating season (March/April). In contrast, supplies of gasoline build, but will become increasingly valuable when weather begins to improve in spring.

Looking at a span of 15-years, we see a pattern where heating oil tends to start selling off into December, heading toward peak demand period. Gasoline tends to hit a low in November or December, and rise into January and spring. Of course, these are seasonal patterns, but extenuating circumstances can differ from year to year.

Not only are distributors selling aggressively, but refiners in some large-producing states are subject to tax on year-end inventory of product. Thus, they have financial incentive to flush heating oil inventories into the market. This surge in supply has usually weighed heavily on the cash market, which most closely affects more nearby futures.

Trading Strategy

My trade recommendation is to buy March RBOB and sell March heating oil, entering the spread at -5 cents or better. As of the close on Tuesday, November 24, March gasoline settled at about $2.02, and March heating oil settled at $2.04.

I am expecting to see a rally in the price of heating oil as soon as we see the first sign of cold weather. That might pull that spread apart to allow you to enter the trade, which should work well into December and January. That gives you time to get the trade on and see these products narrow.

As we head into the winter season, you might see the heating oil start to drop and gasoline rise, and this relationship could invert. It may take weeks for that to develop and the market may go up and down up and down in the meantime. But with this spread, you can weather some of the volatility; then if the conditions change, you want want to reverse your strategy and go long gasoline and short heating oil.

Contract Specifications

RBOB is unleaded gas blended with additives

Heating oil represents distillates as well as diesel fuel

Contract size 42,000 gallons

Price: 1 cent move = $420, minimum tick value $4.20

View full contract specs.

Please contact me with any questions you have about this topic or the markets, and to develop a custom trading strategy based on your particular situation.

Andrew Vallance is a Senior Market Strategist based in Toronto, and is serving clients in Canada. He can be reached at 416-369-7948 or via email at avallance@lind-waldock.com. You can follow Andrew on Twitter at www.twitter.com/LWAVallance.

The data and comments provided above are for information purposes only and must not be construed as an indication or guarantee of any kind of what the future performance of the concerned markets will be. While the information in this publication cannot be guaranteed, it was obtained from sources believed to be reliable. Futures and Forex trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Please carefully consider your financial condition prior to making any investments. Not to be construed as solicitation.

Seasonal tendencies are a composite of some of the most consistent commodity futures seasonals that have occurred in the past several years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in a similar directional manner during a certain calendar year. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and timing of the entry and liquidation may impact the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.

MF Global Canada Co. is a member of the Investment Industry Regulatory Organization of Canada and Canadian Investor Protection Fund.

Futures Brokers, Commodity Brokers and Online Futures Trading. 123 Front St. West, Suite 1601, Toronto, Ontario M5J 2M2.

© 2009 MF Global Ltd. Lind-Waldock, a division of MF Global Canada Co. Toll-free 877-501-5463.

Lind-Waldock promises never to sell your information to anyone. Please view our privacy policy.