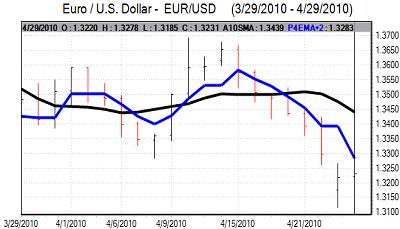

EUR/USD

The Euro held above 1.32 on Thursday, supported by a robust German employment report, even though underlying confidence in the region remained extremely fragile.

The Greek finance ministry suggested that agreement on the support package would be achieved within days. There were suggestions that VAT would rise to at least 23% from 21% while the government would also be committed to spending and pension cuts. There was additional pressure on the German government to back a support package despite the domestic political constraints. Standard & Poor’s backed the current Irish credit rating which provided some degree of support for the currency on hopes that contagion fears could be contained.

Underlying confidence in the Euro-zone economy and Euro was still weak with fears over them medium-term outlook. The evidence suggests that there has been heavy institutional Euro selling over the past few weeks. Put options within the derivatives markets are now at their most expensive since November 2008 which also indicates the important lack of confidence in the currency.

The US jobless claims data was relatively close to expectations with a decline to 448,000 in the latest week from 459,000 previously which does not suggest a major change in the labour market. President Obama announced three nominations for the Federal Reserve board including San Francisco President Yellen as Vice Chairman. Yellen is generally considered one of the more dovish regional presidents and there will be speculation that the FOMC balance will shift more towards favouring low interest rates which is liable to curb dollar support.

The Euro found support below the 1.32 level and nudged higher to highs near 1.3280 before consolidating near 1.3250.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Japanese markets were closed for a holiday on Thursday which limited yen moves in Asia and there are also a series of public holidays next week which will curb activity.

Markets continued to fret over the risk of sovereign debt downgrades, especially within Europe and this provided some support for the yen with the impact limited by the fact that there are also major doubts over the Japanese fundamentals. The dollar edged lower to just below the 94 level in early Europe.

The dollar continued to fluctuate around the 94 level during the US session with the US currency gaining some degree of support from a rise on Wall Street.

Sterling

Political uncertainty continued to hamper Sterling in early Europe on Thursday while unease over the credit-rating outlook also remained a negative factor. It retreated back to near 1.5150 against the dollar despite a firm Nationwide house-price survey which recorded a 1.0% monthly increase for April.

International risk appetite stabilised later in the session which helped underpin Sterling. There was also some speculation that the UK would benefit from a lack of confidence in the Euro-zone with potential investment inflows. The situation could still reverse rapidly, especially as if there is any further speculation over a credit-rating downgrade.

Sterling found support below 1.52 and strengthened to a high near 1.5340 in New York. The opinion polls will continue to be watched closely and any sign that a decisive outcome could be possible would tend to provide some Sterling support, although strong support looks unlikely.

Swiss franc

The dollar was blocked significantly below the 1.09 level against the franc on Thursday and drifted down towards the 1.08 level. The Euro was trapped just below the 1.4350 level against the Swiss currency during the day.

There is still strong institutional interest in Euro selling which will tend to provide background support for the franc.

The KOF index will be watched closely on Friday and a further monthly strengthening in the data would reinforce confidence in the Swiss economy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

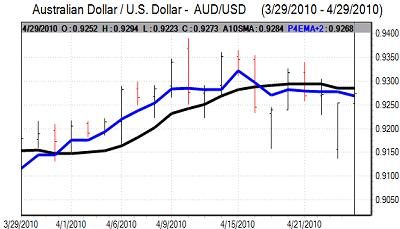

Australian dollar

The Australian dollar rallied back to the 0.9260 area on Thursday. The currency will gain support on yield grounds, but there will be caution over risk appetite which will limit buying support. Ranges were relatively narrow during the day, but there was a firmer net tone and the Australian dollar moved towards the 0.93 area against the US currency as stock markets gained ground.