Baidu.com, Inc. (BIDU) has become one of the growth stories out of China and has been at or near the top of our list of “go-to” stocks all year, especially after the 10:1 stock split back in May. With Google Inc. (GOOG) fading from the search picture in China, prospects for Baidu.com, Inc. (BIDU) have grown even further. It been a great stock for long-term investors and active traders alike, trading well based on both patterns and momentum.

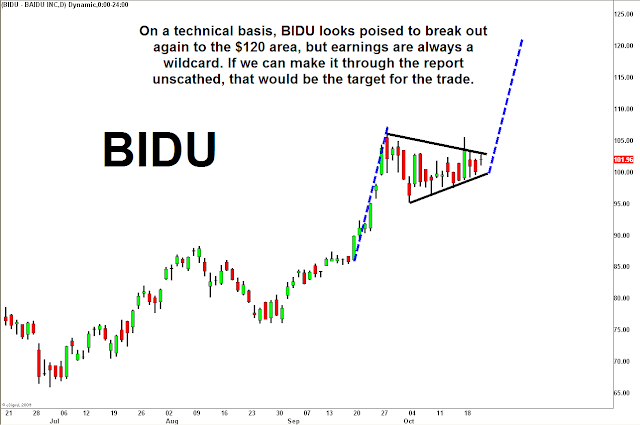

Baidu.com, Inc. (BIDU) stock has gained more than 1,000% in the last two years and nearly 150% year-to-date, and currently trades at a trailing P/E of 106, a forward P/E of 47 and a PEG ratio of 1.18. While the multiples are high, they are not egregious considering how well positioned the company is to grow and monetize its brand in the fastest growing economy in the world. The stock has enjoyed a massive run-up over the past two months, and these levels it is tricky to determine what to do next in terms of the stock. On a technical basis, Baidu.com, Inc. (BIDU) looks bullish: it has consolidated nicely between 97 and 107, and the range is tightening, hinting that a break is coming. Also this morning just before 10:30am we got a bullish cross above the 10-day moving average on good volume. Still, earnings are a wildcard, and the uncertainty over an earnings report supersedes basic technicals. The question begs: after such a strong run into the Q3 earnings report due out this afternoon, is it prudent to get involved at these levels?

Given the recent action, we are cautiously optimistic going into earnings, but it will take a strong street-beating report to push the stock higher. The Street has been fickle in terms of its reaction to tech earnings that topped estimates, buying up Google Inc. (GOOG) and Netflix, Inc. (NFLX) while selling Apple Inc. (AAPL), International Business Machines Corp. (IBM) and VMware Inc. (VMW). Institutional players parse through every detail of these reports, and if there are any concerns (especially with a stock trading at high multiples with strong growth expectations built in) a seemingly positive report can be sold off hard. Still, a stellar report could send BIDU to 115-125 no problem.

While on the surface it feels like somewhat of a coin flip, there are ways to hedge your bets to protect yourself to the downside while allowing you to be involved for a potential breakout. Going into Baidu.com, Inc. (BIDU) earnings, we have a strategy for traders who have been involved in the longer-term trade with us, and a strategy for those who want to initiate a new position. If you are going to initiate a new stock position at these levels into earnings, you should do it in small size (tier 1). At the same time, if you are more risk averse, you can buy some 95 puts to protect yourself in case of a disappointing report. If you are currently long from our latest macro buy at 87-88, I recommend you sell some in the money calls, say a November 95 call, which can bring a pretty good premium to cover potential post earnings losses.

For more, watch today’s appearance on theStreet.com below: