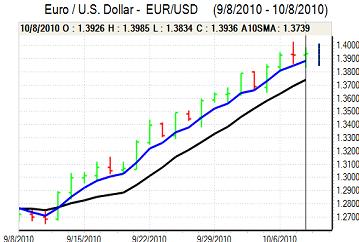

EUR/USD

The Euro retreated to lows near 1.3850 against the dollar in European trade on Friday and then consolidated around 1.3880 ahead of the key US data.

The headline US employment data was weaker than expected with a employment decline of 95,000 for September following a revised 57,000 drop the previous month. There was a sharper than expected decline in government jobs which pushed the total lower and private-sector job creation was broadly in line with expectations at 64,000 for the month. The unemployment rate held steady at 9.6% for the month while the data on weekly hours and earnings was generally disappointing.

The data will do little to improve sentiment towards the economy and currency. In this context, comments from Fed officials will remain under close scrutiny. In remarks on Friday, Regional Fed President Bullard stated that the risks of a double-dip recession had receded over the past few weeks and he was slightly more cautious over the possibility of further quantitative easing, describing the November policy meeting as a close call which will trigger some doubts over a November move.

There were significant comments from Euro-group President head Juncker who stated that the Euro is too strong at this time near the 1.40 level and also stated that the dollar was not in line with fundamentals. The remarks increased speculation that there would be further G7 comments in support of stable currencies and there was a high degree of caution with the Euro consolidating just above 1.39.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There will be a reluctance to buy the yen aggressively on Friday given the possibility of a concerted effort to keep major currencies within ranges. It is probably more likely that there will be less-defined pledges of co-operation which may not have a major impact, although there will certainly be uncertainty over the outcome.

The Japanese current account surplus dipped in the latest month, but there was still a solid surplus and will reinforce the fact that there will need to be net capital outflows to prevent upward pressure on the yen. There was an important element of caution on Friday ahead of the payroll data and IMF meetings with the dollar drifting below 82.50.

The dollar was subjected to renewed selling pressure following the US payroll report with a decline to lows below 81.80 before a very limited recovery to above 82 later in the US session.

Sterling

Sterling fluctuated around the 1.5850 area against the dollar in early Europe on Friday while the Euro was blocked near 0.88.

The UK wholesale prices data was slightly stronger than expected with input prices rising 0.7% for September following a revised 0.1% gain the previous month while output prices rose 0.3%. The main policy focus has been on the potential for further monetary easing to help support the economy.

The producer prices data is a reminder that inflation trends will also need to be watched closely and the latest consumer inflation data will be watched closely next week to assess how much scope the bank has for a more expansionary policy.

Sterling gained strong support following the US employment data with a peak close to 1.5960 and the UK currency held the bulk of the gains later in US trading as the Euro retreated to near 0.8725. Unease over the US and Euro-zone fundamentals will continue to protect Sterling from aggressive selling.

Swiss franc

The dollar pushed to a high near 0.97 against the franc on Friday, but was unable to sustain the gains and weakened back to near 0.96 before consolidating above this level. There were further erratic moves on the crosses with the Euro retreating to below 1.34 before finding fresh support.

There were slightly greater doubts over the possibility of Federal Reserve quantitative easing following Bullard’s comments and this may curb defensive franc demand to some extent, although substantial selling pressure looks unlikely.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

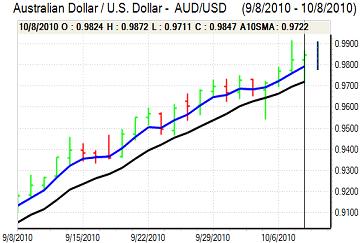

Australian dollar

The Australian dollar weakened to test support near 0.9750 in Asia on Friday. There was pressure for a correction after recent gains with caution ahead of the US employment data also contributing to a negative tone.

The currency regained ground following the US employment data and moved back to the 0.9850 region. Expectations of strong emerging-market growth conditions will help underpin the Australian currency and there will also be expectations of a further flows of funds into commodities which will provide indirect support.