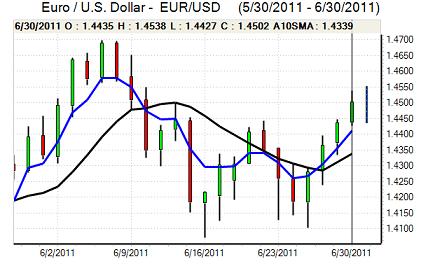

EUR/USD

The Euro pushed above 1.45 against the dollar ahead of the second Greek austerity vote on Thursday and it retained a firm tone throughout the day even with tough resistance seen above the 1.4520 area.

As expected, the Greek parliament approved detailed austerity package provisions and this was the final legislative barrier for the bills. There was relief that the package had been ratified and EU Finance Ministers should approve the next loan tranche for Greece this weekend. There will, therefore, be no near-term debt default for Greece which boosted the Euro and banks will also continue negotiations on terms surrounding a voluntary debt rollover.

There was still a high degree of uncertainty over the medium term outlook given high expectations that Greece will default eventually. There were also still fears surrounding the Euro-zone outlook with a potential contagion threat still very important.

ECB President Trichet re-iterated that the bank remained in strong vigilance mode, reinforcing expectations that there would be an interest rate increase at next week’s council meeting and the Euro gained further support on yield grounds.

The US jobless claims data recorded a slight decline to 428,000 in the latest week from 429,000 previously which did not have a major market impact. In contrast, the Chicago PMI index was significantly stronger than expected with a gain to 61.1 from 56.6 previously. This helped maintain a more positive attitude towards risk appetite with commodity currencies securing further near-term support on hopes that US demand could stabilise.

There was further unease surrounding the US debt ceiling as rating agencies continued to warn over the default risk. Choppy trading will be a threat ahead of Monday’s US Independence day holiday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 80.25 area on Thursday and rallied strongly during the US session with a high near 80.85. There was a further rise in US Treasury yields which helped underpin the dollar, although it was due in part to disappointing US Treasury auctions rather than confidence in the economic outlook, although the Chicago PMI release did provide some relief.

The quarterly Tankan survey was weaker than expected with a decline to -9 from 6 previously while there was a 1.9% decline in household spending. In contrast, the unemployment data was stronger than expected with a decline to 4.5% from 4.7% previously.

The yen found support close to the 81 level and rallied to near 80.75 during Asian trading on Friday.

Sterling

Sterling hit resistance above 1.61 against the dollar in early European trading on Thursday and then weakened sharply with lows below 1.60 while there was a decisive break above 0.90 against the Euro.

There were reports of further Bundesbank Euro/Sterling buying ahead of the month-end and there was also corporate Euro demand. This Sterling selling pushed the UK currency to a 15-month low on a trade-weighted index.

The latest Bank of England credit-condition survey reported that consumer lending standards were set to tighten further during the third quarter which maintained fears over the consumer spending outlook, especially with lending levels already at historically low levels. Underlying confidence in the economy remained fragile and expectations that the ECB would increase interest rates next week further undermined Sterling support.

The rate of selling did ease during the day as month-end demand eased and the UK currency was able to rally above the 1.6050 area against the dollar. The PMI data will be watched closely later on Friday for further evidence on the economy’s health.

Swiss franc

The dollar found support on dips to the 0.8320 area against the franc on Thursday and rallied sharply during the early US session with a peak just above 0.8450. There were strong moves on the crosses as the Euro advanced rapidly with a peak around 1.2240.

Greek developments continued to dominate during the day and there was strong selling pressure on the franc on relief that a near-term Greek debt default had been averted. The franc had gained strong support on defensive grounds and there was a sharp reversal in speculative positions as fear eased. Markets will still be cautious over the underlying outlook and volatility is liable to remain a key feature.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

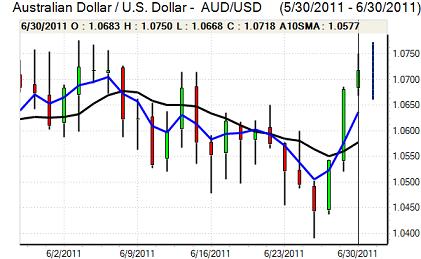

Australian dollar

The Australian dollar rallied to a peak close to 1.0750 against the US dollar during Thursday and then lost momentum after a very strong advance during the previous 48 hours. Global risk appetite improved following the Greek vote which boosted Australian dollar demand, especially with commodity prices also advancing.

The latest PMI manufacturing data was stronger than expected with a rise back to above the 50 level which provided currency support. In contrast, there were reservations over the Asian outlook following the Chinese PMI data and the Australian currency consolidated in the 1.07 area against the US currency.