Shares of the Chinese e-commerce company, E-Commerce China Dangdang (DANG), are up 52% year to date. Following the $0.11 EPS beat and raise on February 27, the stock rallied 90% in less than two weeks before giving up almost all of the gains over the next month. This most recent quarter was the first profitable quarter since 2011 and the sixth consecutive beat of analyst expectations. Revenue is expected to grow 25.9% this year and 20.9% in 2015. Dangdang trades at a price to sales ratio of 1.03x.

Unusual Options Activity

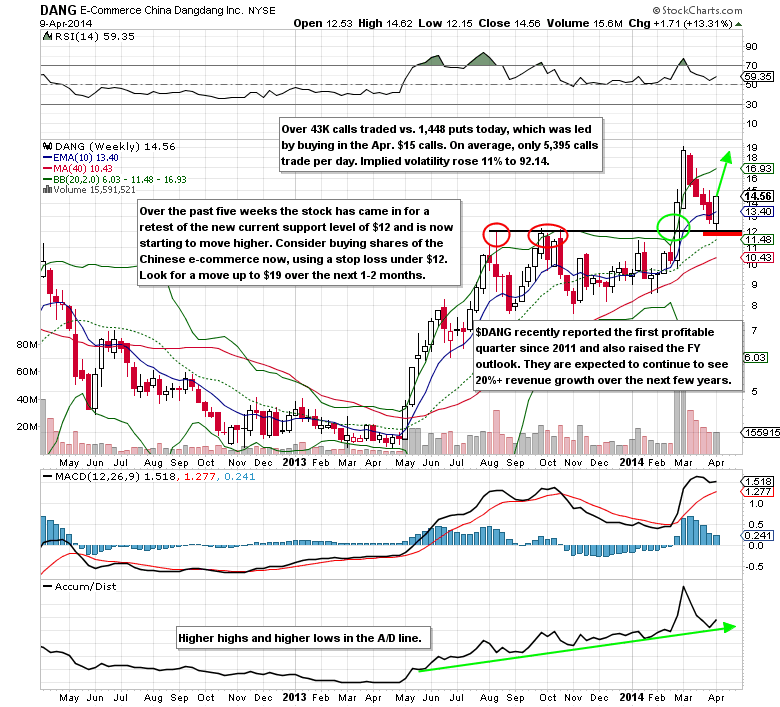

Over 43,000 calls traded vs. 1,448 puts on April 9th, which was led by massive buying in the Apr. $15 calls. Call open interest was 59,160 before the unusual call activity. On average, only 5,395 calls trade per day. Implied volatility rose 11% to 92.14.

Technical Analysis

Dangdang shares tried to close above the $12 level on several occasions last year, but weren’t able to until the earnings catalyst in February. Now that the stock has tested the new current support level and is starting to move higher, look for a retest of the March highs ($18-$20) over the next two months. A stop loss on a stock position can be placed just under $12.

Options Trade Idea

Buy the (DANG) May $15 call for $1.50 or better

Stop loss- None

1st upside target- $3.00

2nd upside target- $4.00

Disclosure: I’m long the (DANG) May $15 calls for $1.34-$1.39.

= = =

Mitchell’s Free Trade of the Day featuring Monster Beverage (MNST)