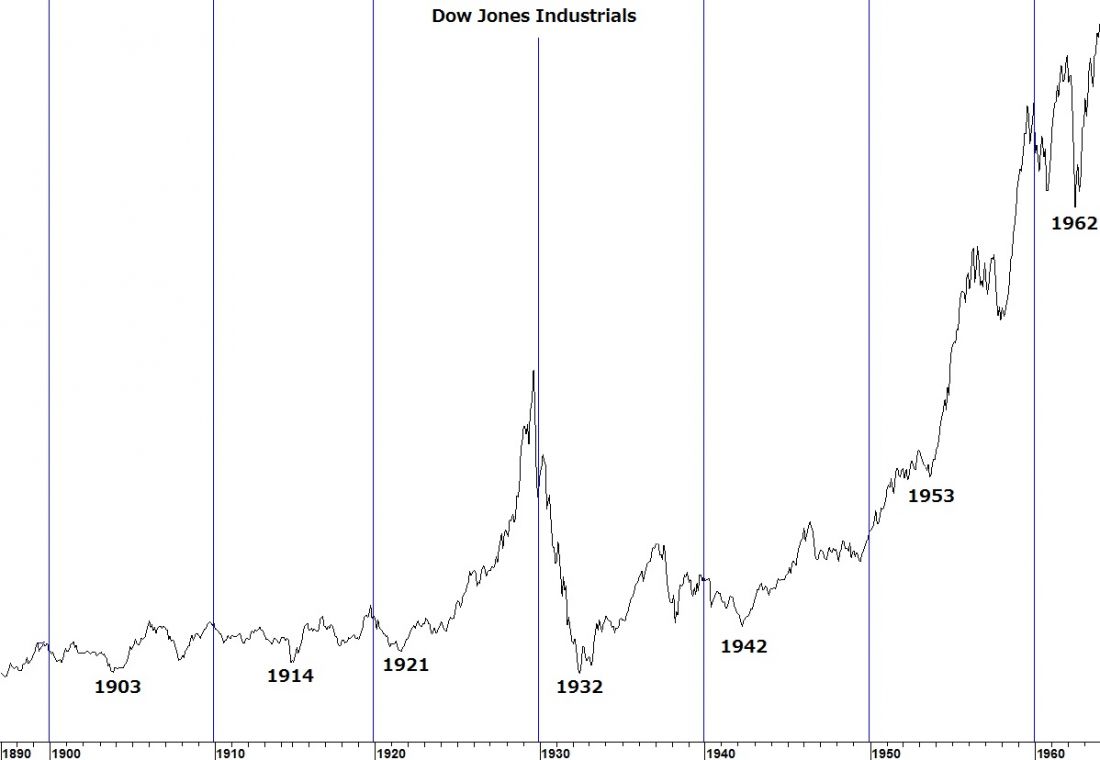

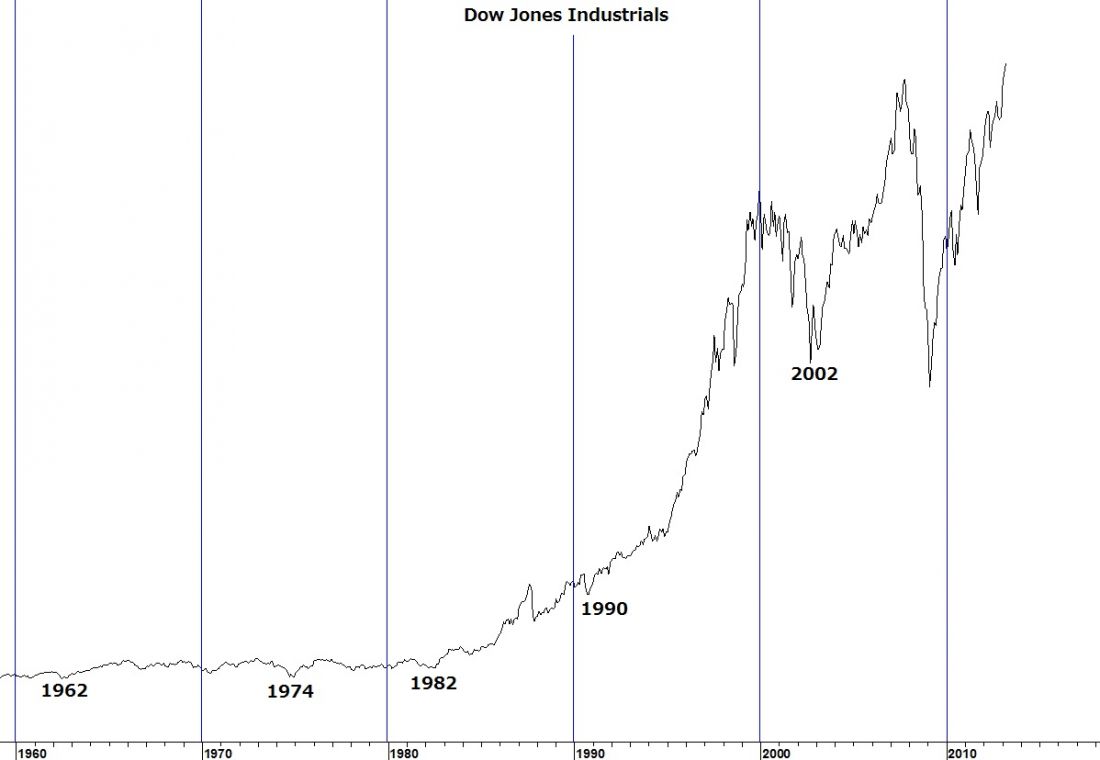

In every decade since 1900, and without exception, the Dow Jones Industrial index has printed an important bottom at some point during the first four years.

The years in which those bottoms occurred are labeled in the charts below. As we find ourselves in the third year of the new decade, an important bottom can be expected at some point before the end of next year: 2014.

ELECTION CYCLE

Americans are now in their 29th election cycle since 1900. An election cycle begins the year of a Presidential election; President Obama was re-elected in November 2012 so the current election cycle began in January 2012, 2013 is a post-election year and 2014 is a mid-term year.

BEAR MARKET STATS

In 19 of those 29 election cycles, 65% of the time, equities suffered through a bear market during either the post-election year and/or the mid-term year. For this report a bear market will be considered a correction of 19% or greater, rather than the traditional 20%.

Since 1900, 18 Presidential election cycles saw their post-election year and/or mid-term year fall into the first four years of a decade. Of those 18 cycles, bear markets occurred 13 different times during either one or both of these two years raising the odds of a bear market this year and/or next from 65% to 72%.

Of those 13 bear markets, In 12 separate cases the market’s decline either started in, or was already underway, by the post-election year. Assuming a bear market will occur at some point during the 2013-2014 period, the odds of that bear market getting started sometime this year are over 92%.

THE COUNTS

While we did see a major low in equities in March 2009, that low is of the previous decade.

MY CONCLUSION

We can either expect to see another bear market sometime this year and/or next, or see the first failure ever of this pattern.

[Editor’s note: Request a free copy of the March Special Report: Lindsay Analysis from Seattle Technical Advisors.com.]

= = =

More stories: