Just a reminder, these charts are posted as examples of the trades on the nightly COT Signals email. These trades will help illustrate the mechanics that go into creating the nightly email.

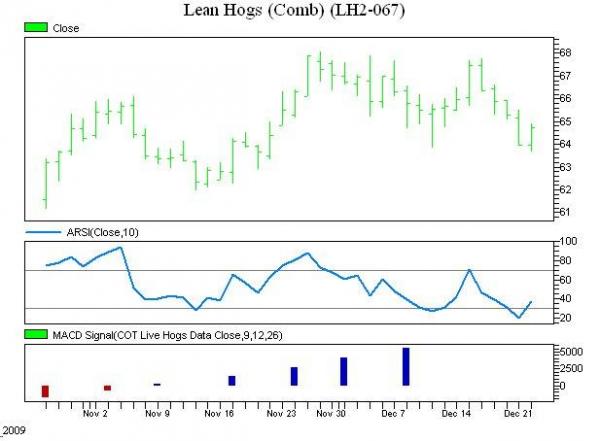

February Lean Hogs have seen a steady build in commercial buying interest going back to early November. Currently, the market has come back to good support around $64 after failing to make a new high for the move last week.

Technically speaking, this is a classic pullback and test of support in an upward trend with growing commercial support keeping us on the lookout for the opportunity to buy a pullback.

Other factors in this market are currently, a bit conflicted. Seasonally, this tends to a be a weaker period for Hogs as the packers have already allotted for holiday demand. However, the February contract is currently trading more than $1 below the cash index when the normal premium for this time of year is at least $4 above the cash index.

Ultimately, we trade the trade. Buy February Hogs and risk them to Tuesday’s low of $63.65. The first objective on the upside is the resistance around $68.

Any questions, please call.

866-990-0777