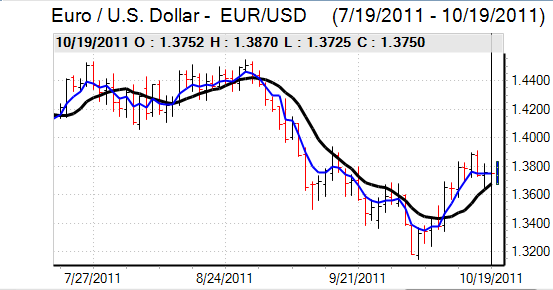

EUR/USD

The Euro initially found support in the 1.3750 area against the dollar on Wednesday and rallied to a high above 1.3850 ahead of the US open and again following the latest batch of US economic data

The housing data was stronger than expected with a gain to 0.66mn for September from a revised 0.57mn previously. The enthusiasm was tempered slightly by the fact that permits fell over the month, butt here was a more positive tone following the NAHB index yesterday.

The headline consumer prices index rise was in line with expectations at 0.3% while the core reading was slightly lower than expected at 0.1%. The Fed’s beige Book generally reported that modest growth continued during September, although some districts were slightly more optimistic. The net impact was to lessen recession fears slightly, although the tone remained very cautious.

The US data impact was generally short lived as markets returned their focus to the Euro-zone. With the countdown to Sunday’s EU Summit well underway, there was a flurry of diplomatic and political activity during the day.

There were unscheduled meetings between German Chancellor Merkel and French President Sarkozy and there was also a contribution from other key officials such as ECB President Trichet. There were tensions surrounding the EFSF as leaders were still looking at ways to increase the fund’s firepower through leverage without jeopardising the AAA credit ratings. France was still pushing for the EFSF to be turned into a bank with ECB backing, but there was strong resistance from the German government and the ECB itself. The Euro failed to hold above 1.38 and dipped back to the 1.3750 area during the US session.

There were further concerns over European bank funding as emergency borrowing form the ECB continued to increase and the Euro dipped to test support near 1.37 in Asian trading on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found some support in the 76.70 area against the yen during Wednesday and edged higher to, but there was no challenge on the 77 level.

The currency gained some support from the US data, although the impact was notably subdued as market attention was focussed elsewhere.

There was further speculation over capital repatriation from the Euro-zone which underpinned the yen and the Japanese currency also gained support from a deterioration in risk appetite on Thursday. Government confirmation that a taskforce will be set up to alleviate problems caused by a strong yen did not have a major impact.

Sterling

The latest Bank of England monetary policy minutes recorded 9-0 votes both for the interest rate and the quantitative easing decisions. There had been some speculation that a minority may have objected to additional bond buying, but there was a marked change of tone in the minutes as global and domestic economic fears increased sharply. There had been some discussion whether to increase the bond buying of programme by GBP100bn rather than GBP75bn.

Sterling was unsettled by fears over the domestic economy, but international considerations provided some net support as the UK position outside the Euro area was deemed positive. There could still be sharp swings in sentiment over the next few days, especially given the UK banking-sector vulnerability and Sterling moved back to the 1.57 area as the US currency secured renewed support.

Swiss franc

The franc remained firmly on the defensive in Europe on Wednesday with further speculation that there would be a change in the Euro minimum level, especially as there have been further domestic calls for the minimum level to be increased.

The government stated that the franc was still very strong, but did not expand on the comments and there were no announcements at the weekly press conference while the National Bank made no comments. The Euro faltered at 1.2470 against the franc, but did find support in the 1.24 area which enabled the dollar to regain the 0.90 level during the New York session as there was little incentive for franc buying.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

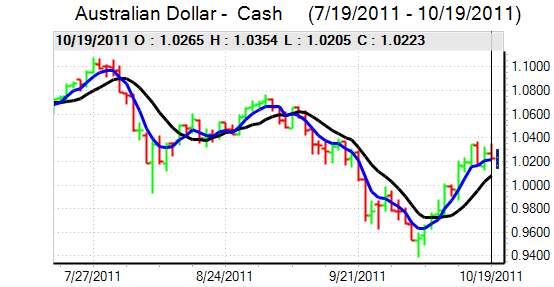

Australian dollar

The Australian dollar hit resistance in the 1.0350 area against the US currency on Wednesday and, significantly, it was unable to exceed the high point seen on Tuesday as international considerations dominated.

There were fresh doubts surrounding the Euro-zone rescue plans during New York trading which also dampened risk appetite and pushed the Australian dollar to lows near 1.02. Regional equity markets fell sharply on Thursday which also had a negative impact on the Australian currency as it retreated to near 1.0150 with a decline in commodity prices also having an important impact as the NAB quarterly business confidence index also declined. Conditions in the Chinese economy will continue to be monitored very closely.