People wanting to get started in the Forex market normally have 3 common questions. What is Forex, how is it traded, and how do traders find trading opportunities? In today’s article, we will answer all 3 of these questions to better prepare you for trading in this exciting market.

What is Forex? How is it Traded?

The Foreign Exchange Market, or “Forex” Market, is the largest market in the world that has $5 Trillion in average trading volume per day. Governments, international companies, and banks have a constant need to exchange their home currencies for other currencies around the world to transact business and the shifts in supply and demand cause each of these currencies’ values to fluctuate up and down. It’s these fluctuations that attract speculators (Forex traders) to this market.

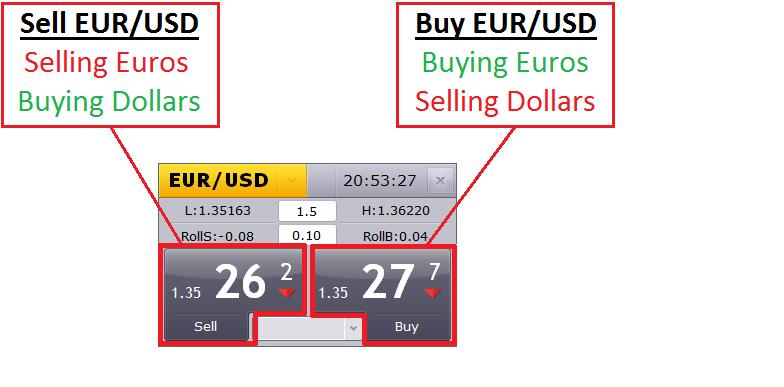

When Forex traders place a trade in the Forex market, they trade what’s called a “currency pair.” A pair consists of two currencies where traders exchange one currency for another. This oftentimes confuses traders coming from other markets where instruments are quoted as single products in US Dollar terms. The reason Forex quotes are shown in pairs is because we need to know what currency we are exchanging for the other. The image below sheds more light on this.

The EUR/USD is the most popular pair in the Forex market where traders can exchange Euros and US Dollars. We can decide the direction of the exchange by either buying or selling this pair. If we were wanting to purchase Euros with US Dollars, we would buy the EUR/USD pair. If we were wanting to purchase US Dollars with Euros, we would sell the EUR/USD pair.

EUR/USD buyers hope the exchange rate goes up, whereas EUR/USD sellers would hope the exchange rate goes down. The traders could then close their position by exchanging the currencies back at a more favorable rate. We can close out a buy trade by selling the currency pair, and vice versa.

How Do Traders Find Trading Opportunities?

There are two main types of analysis that Forex traders use to identify trading opportunities, fundamental analysis and technical analysis. Many traders use a combination of both analysis types, but usually favor one over the other.

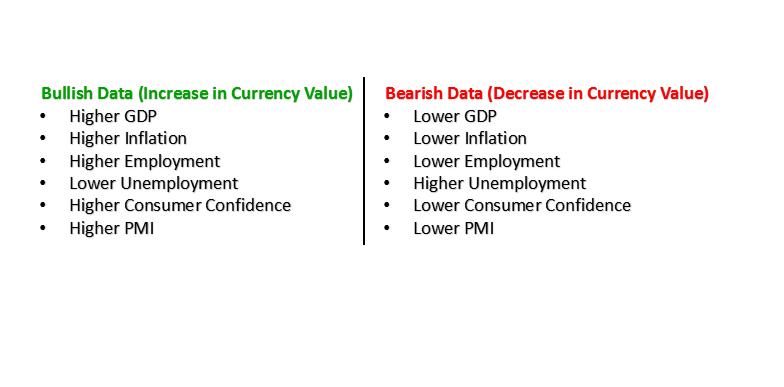

Fundamental analysis is using economic data from a currency’s home country in an attempt to predict the currency’s future value. Economic data like interest rates, GDP, inflation, employment, consumer confidence, and PMI all factor into what the currency’s future value could be. These data points are often released at set times each month by countries around the world. Searching for “Forex Economic Calendar” online would help you find the full schedule for currencies that interest you. Also, here is a handy impact guide you can reference when an economic figure is released

Technical analysis is using previous price moves in an attempt to find patterns that could indicate where future prices could go. Traders will use charting software to track historical prices and add technical “indicators” that can be used to identify ideal times to buy or sell each currency pair. There are 100’s of tools and indicators that can be used on Forex charts to develop a strategy. It is suggested that you test trading strategies on a paper-trading demo account before risking real money and only trade with real money once your strategy has been profitable in a demo environment

In Conclusion

Hopefully this article has answered the biggest questions in regards to getting started in this market. Once we understand what the Forex market is, how currencies are traded, and how traders look for trading opportunities, it’s time to take action on a demo or real account to begin practicing with strategies.

[Editor’s note: Check back next week for part 2 in this Getting Started in Forex series by Daily FX.]