When news hits the wire intraday and there is a reaction to the news either or good or bad it can be an opportunity for a day trader to capitalize on.

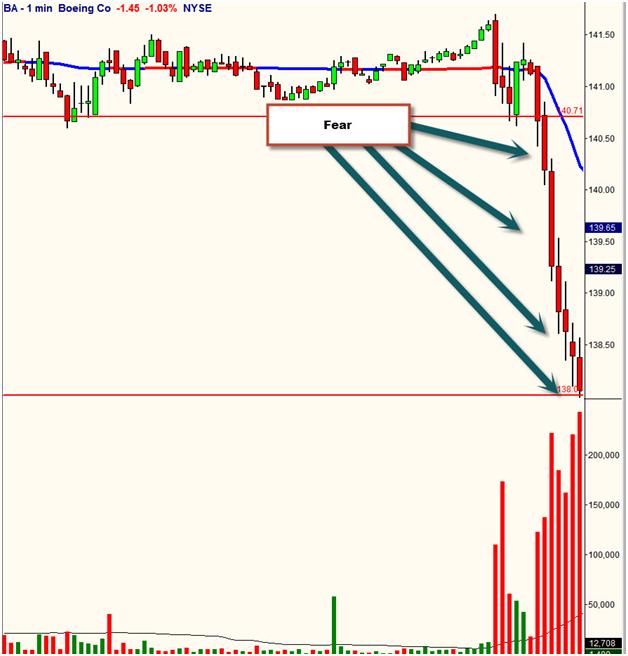

For example, here’s an excerpt from when Tuesday’s news on BA (Boeing Co.) hit the wire, “BA moves lower – Smoke came from a Japan Airlines Boeing 787 undergoing maintenance yesterday afternoon Tokyo time at Narita International Airport, JAL spokesman Seiji Takaramoto said in telephone interview – Bloomberg reports.” This news created a negative response in the price action of BA.

This picture of fear creates an imbalance of supply and a lack of demand that can create a nice bounce back if played out nicely. My main rule of thumb in playing these types of intraday moves is look to the prior weekly or daily trend and stick with the present trend.

Look for small time frame reversal for entry to capitalize on the potential bounce. This is a high odds, low risk trade that a lot of day traders use.

Stick with the prior bigger timeframe trend and these types of overreaction news events are nice trades that can pay well to the trained trader. This was a live trade I personally traded and called live entry, stop and target to our online trading room.