Many FX Traders spend time learning how to spot trends or reversals on the chart without focusing on what causes those trends or reversals. The news, or fundamentals behind a currency pair, is often the reason for major moves that traders look to trade. Today, you’ll receive a basic primer on major economic reports and how they impact Forex.

[Editor’s note: this is part two in a Learning To Trade Forex series. Read part one here. ]

What Are Fundamentals?

Before you were a trader, you likely only knew of fundamental analysis of any market. If you’ve ever heard of the term, supply and demand, then you have rough idea of the forces of fundamentals. Fundamentals assess the economic well-being of a country through many different factors like employment growth, inflation, and consumer demand.

There are many key fundamental drivers however, only one is by and away the most followed by banks, traders, and economists. The most popular fundamental driver is interest rates. The reason is that Interest Rates determine everything in financial markets. Lending, spending, and economic growth are directly affected by interest rates and that is why for the last several years, many central banks have kept interest rates near zero in order to induce borrowing and spending in order to spur growth.

Major News Announcements You Need to Know About

• Interest Rates Announcements (Central Bank Announcements)

• Central Bank Minutes

• Inflation Readings (CPI, PPI)

• Employment Reports (Non-Farm Payroll, Unemployment Claims)

• GDP / Growth

• Consumer Demand (Retail Sales, Durable Goods Orders)

• Sentiment (Consumer Sentiment, ZEW Survey)

These events are seen as high importance events and if you’re trading a currency that has a high importance event coming up, it is best to pay attention to how the news prints in relation to expectations.

Why You Need To Understand Fundamental Drivers

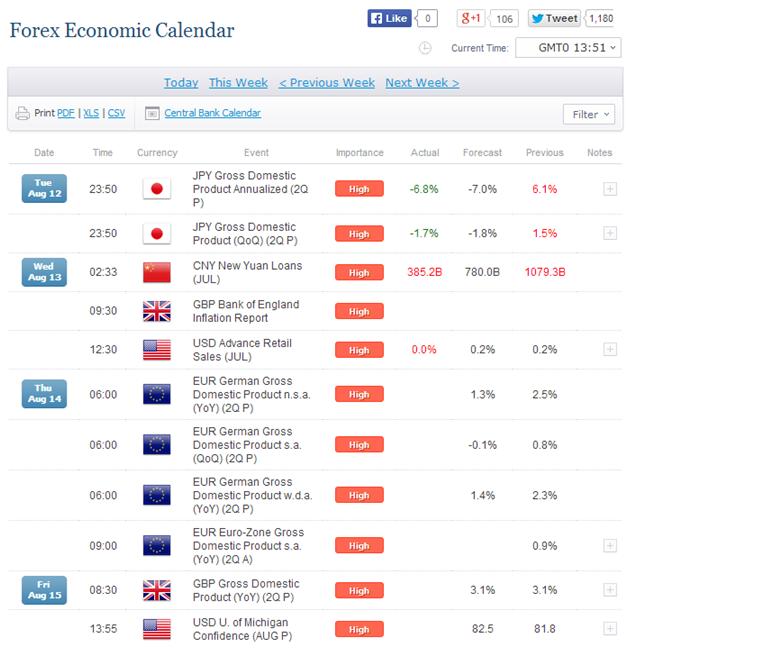

So far, we’ve discussed that interest rates are the most important fundamental factor to every currency. Other economic events like Jobless Claims, Non-Farm Payrolls, and inflation reports are drivers to the overall economic picture and interest rates. Therefore, we can look to an economic calendar to tell you what Economic Announcements to expect to see on a case-by-case basis, the health or weakness of an economy:

Every Trader Needs Access to an Economic Calendar

It is important as a trader to have access to a calendar of economic news announcement. Because individual prints that miss economists’ estimates will likely move a currency fast and depending on the news event, you may want to exit a trade that you entered on a premise that the news and health of an economy was moving in a different direction.

How Fundamentals Move Forex – Missed Expectations

The air that all financial markets breathe is that of expectations. Specifically, expectations of key fundamental prints that drive further expectations of future value.

An expectation is a strong belief that something will take place in the future and markets have a tendency to price that in. When an expectation goes awry, then the price changes and sometimes it does so aggressively.

Lastly, here’s an example of initial and subsequent moves we’ve seen on the European Central Bank or ECB rate announcements. As you can see from the leftside of the screen, a sideways move was met with an abrupt move lower. Recent ECB events have continued to bring EURUSD expectations lower and now that you know what the key news events are and how to read them, hopefully your trades will be enlightened from here on out.

In Conclusion

Every FX Trader needs to have a grasp on the fundaments. When you understand the trend, strong or weak, that fundamentals are moving, you can get a better grasp of price action and potential trades. Traders who can pair up strong fundamentals with favorable technical patterns will go on to have a consistent edge so long as risk is well managed.

Happy Trading!