On Thursday, October 17, Goldman Sachs (GS) is set to report Q3 earnings before the bell.

Analysts are looking for $2.58 in EPS and revenue of $7.4 billion. They have beat EPS estimates for seven straight quarters by an average of $0.77. According to EarningsWhispers.com, the whisper number for Q313 is $2.80. Wall Street may be pricing in a less than an expected beat if recent history is any indication. We could actually see year over year EPS growth from Q3 of 2012, which is currently expected to decline over 9%.

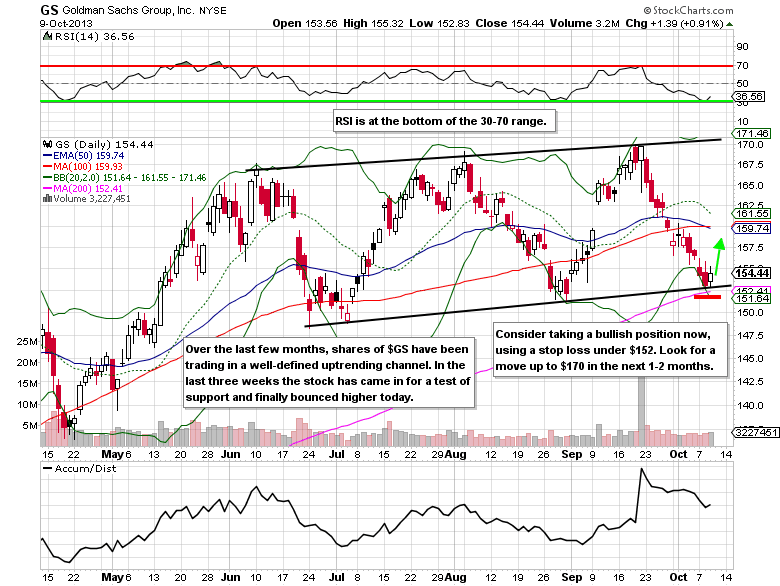

THE TECHNICAL TAKE

Since the September 19 print of $170.00, shares of Goldman Sachs have fallen 9.15% in three weeks. This latest decline has brought down the stock to bottom of the three month uptrending channel. On October 9 GS confirmed a short-term bottom just above the 200-day simple moving average.

GS OPTIONS TRADE IDEA

The Trade: Buy the GS Nov $155/$170 call spread for a $4.70 debit or better.

(Buy the Nov $155 call and sell the Nov $170 call, all in one trade.)

Stop loss: None

Upside target: $14.00-$15.00

Maximum risk: $4.70 (-100%)

Maximum upside: $15.00 (+219%)

Check out Warren’s free trade of the day featuring Nu Skin Enterprises (NUS).