The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Thursday, May 06, 2010

Hours of research consolidated for you

How are you going to vote?

- You are a British Citizen voting in your national election today.

- People are telling you that a hung Parliament will be bad for the Pound because everything will be frozen and government will have more difficult time acting. I’ll opine if that happens, and the odds are already factored into pound, it will be a plus for the currency for that very reason.

- You are a German voter and will be casting your ballot in regional elections soon.

- You are an elected official making your choice known on German participation in the Greek bailout tomorrow. The video and TV coverage there may not help you cast an “aye” on that one.

- You are investors in US and world stock markets-lots of ways to go but your ballots are your Bolivars (if Caracas, at least)-you can also abstain and hope for the best.

If you have been looking at my article titles and reading the text and looking at the charts, you know that I have tried to prepare you for the volatility in the markets that were suggested by the data. But gee whiz, yesterday was amazing.

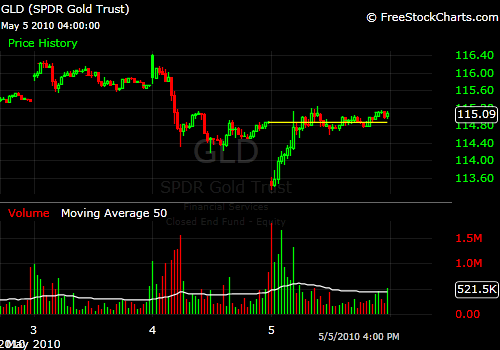

Massive gap-down in gold and recovery to close positive: 10 ninute chart

- The NASDAQ and S&P500 closed under their 50 Day MAs.

- This is a key level for institutions..

- The A accumulation number IBD computes dropped from 628 to 421.

- The Bs declined 434 to 1937.

- The As and Bs are supposed to the best and the ones you buy if you follow the IBD rules. The As have been cut in half in the last week.

- This is distribution in a major way.

- Down volume was 3x+ the risers on the NYSE and NASDAQ.

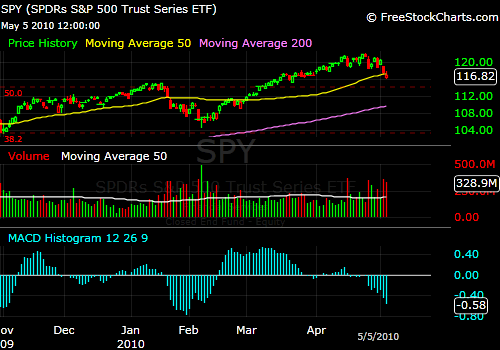

The SPY etf for the S&P500…looking for support-see any?

The S&P had a huge battle and major undertaking to eclipse 1150 and then 1160 so there should be some buying come around that level. At 1152.83, we have the .618 Fib on the 2010 range and 1150.45 was the January 19th high before the drop to nadir on February 5th, which is the point from which this recent upsurge started.

The are a lot of charts that look like the S&P and some much worse. This is Myriad Genetics which had been an IBD top 5 stock. Two earnings disappointed and destruction. You can’t buy and hold much these days. Down almost 60% off the highs and a good company.

IBD went to Market in Correction which is advice not to enter into new longs until the dust settles.

This is a hernia market or a Dolly Parton market…support is very important so we will have to see where it is.

JohnR.

Goldensurveyor.com