I love looking at charts. It’s a characteristic most traders can relate to. My trader friends and I often exchange very unique charts with one another. Often, I’ll grab a chart and send it to a friend and simply ask them, “How Would You Trade This?” (removing any clue as to what the chart represents). I only let them know what length of time is involved and what percentage gain or loss has occurred.

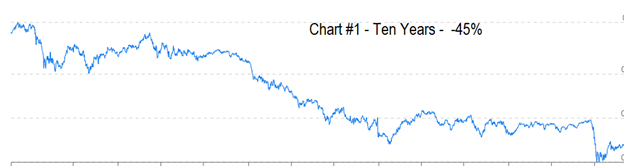

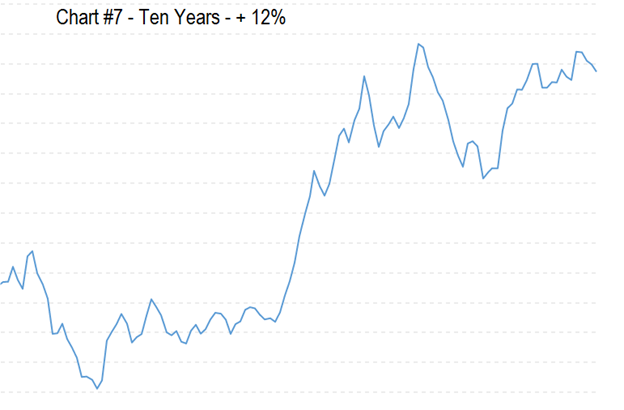

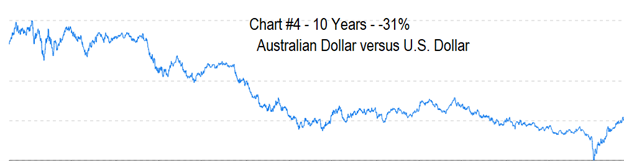

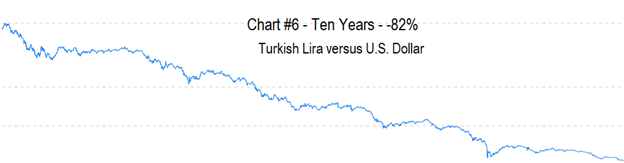

Why don’t you try it? Here are eight charts to look at and I want you to quickly determine how you would trade them. They are all ten-year charts of a financial asset. Looking at the following would you buy, sell or stand aside?

So…what would you do?

Do you notice anything in these unusual charts?

Look for the most obvious thing that jumps out at you when you first lay your eyes on them.

There were eight charts.

Seven of them were down over ten years.

Only one of them showed positive gains.

Please fasten your seat belt as we reveal what these charts represent!

The charts shared are the major foreign currencies of the world over the last ten years. These charts represent the purchasing power of Nation States over the last decade!

Look at them again. This time we’ll label the chart, so you’ll know what country’s purchasing power you are reviewing.

You’ve now looked at 8 different currency charts. What do you think this means for the purchasing power other countries outside the United States moving forward? What conclusions would you draw if the trend of the last decade continues as economic policy? What conclusions would you draw based upon a post COVID-19 world where the floodgates of the monetary printing press are wide open and flagrant currency debasement is occurring?

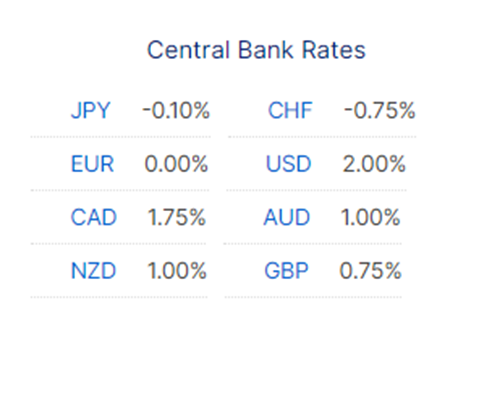

Why is the U.S. Dollar stronger over the last ten years relative to other foreign currencies? A picture paints a thousand words. Look at the following graphic of Central Bank Interest Rate policy around the world. Where would you invest your money? Money flows where it is treated best.

The U.S. Dollar offers the highest interest rates in comparison to the other G8 nations.

The U.S. Dollar is the world’s reserve currency. This means that in times of great stress the bias and tendency is for people to try and get into U.S Dollars because the Dollar is perceived to be a safe haven. While this perspective is very true and real, it only explains safety in relation to other currencies. When you compare the U.S. Dollar to products, goods, and services you still witness and experience a relative loss of purchasing power because of the inflation that is occurring. It’s not as bad as the rest of the world – but like a melting ice cube, your purchasing power is declining because of Central Bank currency debasement. The long and short of it all is that you are doing better than the rest of the world, but as Hedge Fund Manager Ray Dalio says, “cash is trash.”

I’ve been thinking about these charts a lot lately based upon a recent article in the Wall Street Journal just a few days ago.

The Biden administration just passed a $1.9 trillion Covid-19 relief bill. No sooner is the ink dry on that legislation and we are already hearing that another $3 trillion to $5 trillion spending bill will be coming within the next few months.

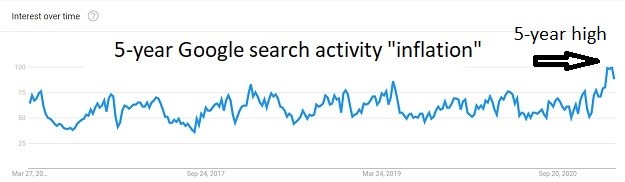

Just look at the Google searches for the word inflation to give you an idea of how people feel about all this new money entering into the economy.

More money has been created recently than any other time in history and the Federal Reserve is telling us that they have inflation under control.

“Pay No Attention to The Everything Bubble Folks!”

As I wrote in last weeks article,

“When investors and traders examine the macroeconomic landscape looking for opportunities, it’s quite a myriad of contrasts. We have interest rates at all-time lows and investors are incapable of earning any yield in the Treasury market. Stocks, when measured against historical valuations, are trading at the highest levels in history. Likewise, Real Estate and housing has never been more unaffordable. The alternative asset class of the Crypto market has seen its greatest run in financial history. All of this has occurred against the largest money supply increases in the history of the world.”

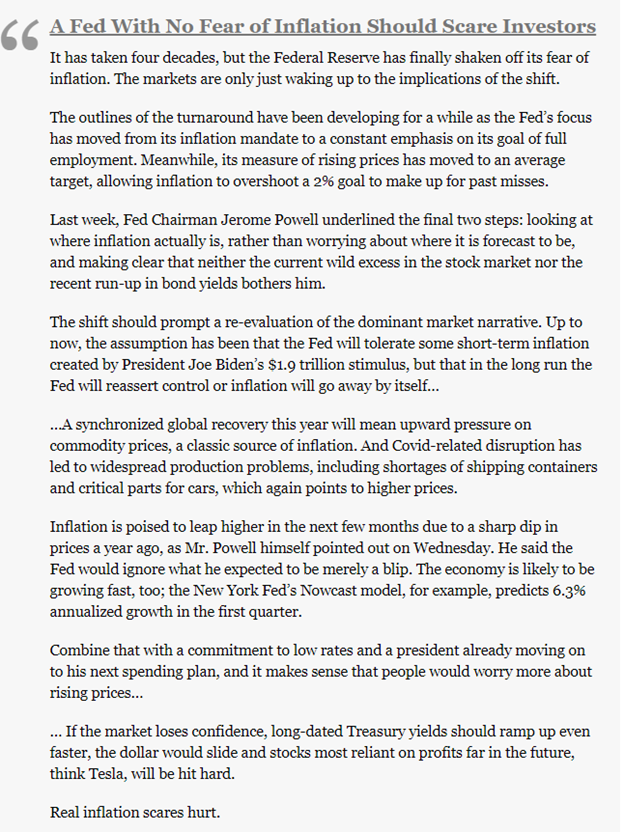

A quick summary of the Wall Street Journal article is available here:

The Fed is asking us to ignore the recent boom in Commodity prices.

Pay no attention to the reality that Crude Oil prices were negative one year ago and this year have topped $70.

Pay no attention to lumber prices which are 200% higher than a year ago.

Pay no attention to Commodity Research Bureau Index which is up 76% in the last 11 months.

The thought process in the United States at the moment is that Fed Chairman J. Powell and other organizations are going to aggressively pursue inflation levels over 2% for a persistent period of time.

That rhetoric sounds great but controlling inflation and the loss of purchasing power it creates is much more difficult than some theoretical understanding of how an economy works.

More importantly, inflation is staring in the eyes of people who have been eyeing the amount of new money created by the printing press. PIMCO co-founder Bill Gross (formerly known as the Bond King) said that he anticipates inflation levels will hit 3% to 4% in the next few months. If Gross is correct, that would mean that the Federal Reserve will be forced to respond with increasing interest rates and other inflation control mechanisms, later this year. The Fed says they won’t overreact to any short term inflation and that there is no plan to raise interest rates this year.

Sounds like the ingredients for a really crazy situation. If history is to be a reliable benchmark we can almost rely on the fact that you will lose purchasing power amongst all of this drama. U.S. Dollar will do better than other currencies but any way you look at it currency debasement is on full display.

Look at the charts again in this article. Seven of the charts show a loss of purchasing power over the last decade. Turkey last weekend saw President Erdogan fire its Central Bank chief for raising interest rates. In a matter of days, the Turkish Lira lost 20% of its value. Historically, when a currency loses 20% of its purchasing power in a month, it never returns. Usually, hyperinflation sets in very quickly. Turkey has lost 82% of its purchasing power in the last decade.

Every fiat currency in the world has the same identical structure:

- They are backed by a government

- They are not pegged to any commodity of value

- Their currencies are all slowly debased by inflation

- The average lifespan of a fiat currency is about 50 to 75 years

- The rate of debasement is set and established by a group of monetary authorities and experts who we are required to trust will manage the value of the currency effectively

When citizens are confronted by this reality, wealthy ones immediately treat fiat currency like a hot potato. They use it to acquire other assets to store their wealth in. Things like real estate, stocks, precious metals, collectibles, art, numismatics, etc. become money magnets to avoid the slow destruction that all fiat currencies eventually face.

However, the financially illiterate, unaware of the dangers associated with fiat currency, leave their wealth in cash only to see it evaporate like an ice cube on a hot summer’s day by the monetary experts. This debasement is not an act of God, it’s not merchants raising their prices haphazardly, it’s not speculators betting on a lower currency value.

It is policy.

The U.S. Dollar as the world’s reserve currency will benefit from dollar inflows as other nation states debase their currencies moving ahead. But that should not act as comfort to anyone. As investors and traders, we are all forced to do whatever possible to protect the purchasing power of our hard-earned dollars.

The race to debase is very real.

What are you doing to protect the value of your assets?

Currency debasement is no longer a theoretical argument. It is a transparent government policy. Position yourself accordingly.

The bottom line, is what do you do with this kind of information? How do you make sense of the massive disruption that the “Everything Bubble” portends for traditional finance?

What analytical tools are you using to find high probability trades and investment?

Remember, artificial intelligence has decimated humans at Poker, Jeopardy, Go! and Chess. Why should trading be any different?

Intrigued?

Visit with us and check out the a.i. at our Next Live Training.

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

Think about these things as you protect your hard-earned money. We live in very interesting times.

It’s not magic. It’s machine learning.

Make it count.

IMPORTANT NOTICE!

THERE IS SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.