The late technician George Lindsay wrote that his concept of Middle Sections was his first original idea on the stock market, and it was his best. He called it his “prize way of calculating time in the market.” Using them in combination with his other unique concepts enabled him to forecast the highs and lows of bull and bear markets (See George Lindsay’s An Aid to Timing, SeattleTA Press, 2012).

My own work with middle sections has evolved into what I call a “Hybrid Lindsay” forecast. It is a combination of Lindsay’s middle section model and short-term intervals combined with traditional cycle analysis.

While the previous forecast published here on February 17 calling for a high that week was two weeks early, readers at the website Seattle Technical Advisors.com knew to stay bearish as my hybrid model is forecasting a low now (until the laws of physics are repealed it is impossible to have a low without a previous high). Hybrid forecasts are often exact but, just as often, they can be off by as much as a week. A two week miss is rare but does occasionally happen. The core of the hybrid forecast is to find confirming middle sections – one from the basic cycle and one from the multiple cycle. My current forecast is outlined below.

Basic Cycle

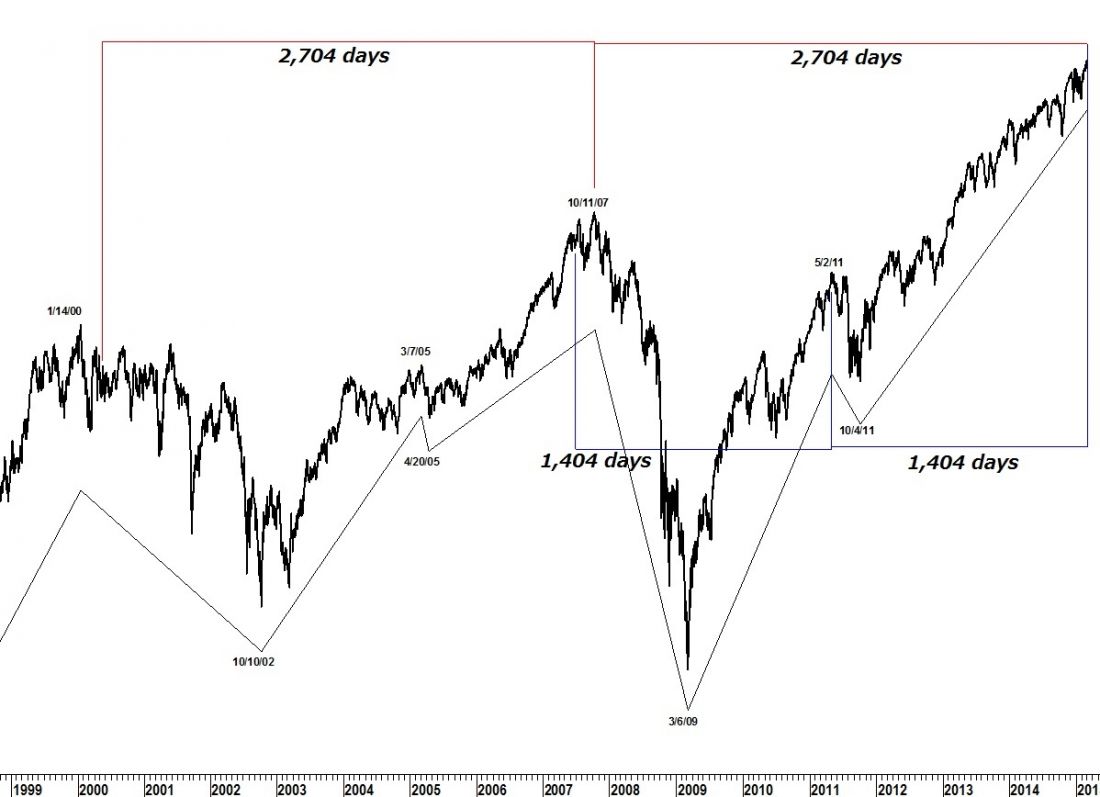

A small ascending middle section is found in June/July 2007. Point E is on 6/28/07. 1,404 days later is the high of the basic cycle on 5/2/11. Counting 1,404 days forward from the May high targets a low on March 6.

Multiple Cycle

The forecast is not complete without a confirming forecast from the multiple cycle. Point E of a descending middle section in the spring of 2000 counts 2,704 days to the high of the multiple cycle on 10/11/07. 2,704 days later is Saturday, March 7.

222

Lindsay’s 222-day interval (221-224 days) targets a low Mar 6-9.

Cycles

Short-term cycles point to a low on March 6.

#####

To get your copy of the March Lindsay Report from SeattleTA, please click here.