EUR/USD

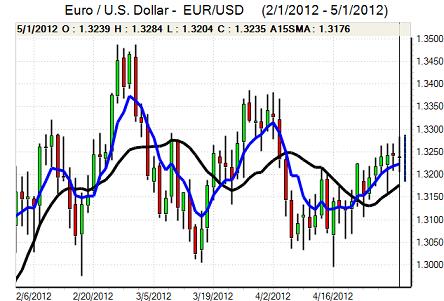

The Euro challenged levels above 1.3250 against the dollar in Europe on Tuesday and pushed briefly to a one-month high above 1.3270 before drifting weaker in narrow ranges.

Most European markets were closed for the May Day holiday which dampened activity. The latest opinion polls continued to point to an Hollande victory in Sunday’s Presidential election, maintaining unease over potential friction with Germany, especially as Chancellor Merkel continued to indicate that Germany would hold firm on economic policy. Tensions will inevitably remain high over the next few days, although much of the impact may now be priced in.

There was also an important element of uncertainty surrounding the Greek election with former Finance Minister Venizelos warning that Euro membership was not certain. There were further concerns surrounding the Spanish economic outlook with a particular focus on the banking sector given the scale of bad debts.

The latest US ISM manufacturing index was stronger than expected with an increase to a 10-month high of 54.8 for April from 53.4 previously, contrary to expectations of a modest decline. All the main components showed healthy gains for the month which helped alleviate immediate concerns surrounding the US outlook, especially as markets were braced for a more subdued report.

There was a significant rise in US Treasury yields following the data and risk appetite also strengthened. Notably, there was selling pressure on the European currencies as US yields increased with the Euro retreating to lows at the 1.32 level before rebounding slightly. Caution surrounding the outlook is still likely to prevail given that the US payroll data is due for release on Friday. The Euro held little changed in Asian trading on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained on the defensive against the yen in Europe on Tuesday and dipped to lows near 79.60 ahead of the US open. There were warnings from Japanese Finance Ministry officials over recent yen appreciation which reminded markets over the intervention threat, although there was no sign of any action at this stage.

The dollar advanced strongly following the US economic data with a move back to the 80.20 region as yield support improved. There was also a reluctance to hold long yen positions below the 80 level given the potential for official action.

Markets were braced for holidays over the remainder of the week which curbed activity on Wednesday. The US currency maintained a robust tone during the session as yield support remained higher with a test of resistance in the 80.40 area.

Sterling

Sterling was unable to make any strong impression on the dollar in early Europe on Tuesday with selling pressure towards the 1.6250 level. The Euro hit tough resistance close to the 0.82 level.

The latest UK PMI manufacturing survey was weaker than expected with a decline to 50.5 for April from a revised 51.9 the previous month. There was a decline in export orders as wider Euro-zone confidence deteriorated and there was also a fifteenth successive decline in backlogs which suggested that production would remain subdued over the next few months.

The UK currency tested support below the 1.62 level where solid buying support emerged. The PMI data will continue to be watched closely during the week with Wednesday’s services-sector data likely to be extremely important for the currency given its impact on Bank of England expectations and international sentiment.

Swiss franc

The dollar found some support in the 0.9050 region against the franc on Tuesday and moved back to test resistance near the 0.91 region as European currencies edged generally lower. The Euro found some support below the 1.2010 area against the Swiss currency which inevitably invited fresh speculation over intervention to protect the minimum Euro level.

The difficulties in finding an attractive defensive currency intensified following the Australian interest rate cut and this could trigger additional capital flows into Swiss assets.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar initially remained on the defensive during the European session on Tuesday following the larger than expected Reserve Bank interest rate cut. There was some recovery in New York, especially on the crosses as the stronger than expected US data helped boost risk appetite. There was a slightly firmer tone surrounding Asian equity markets which provided some support currency protection.

The currency was still broadly on the defensive and stalled in the 1.0350 area during Asian trading on Wednesday with little in the way of fresh incentives during the session.