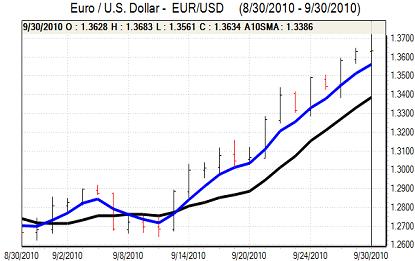

EUR/USD

The Euro found support below 1.36 against the dollar in early Europe on Thursday and tested resistance near 1.3650 during the day, but did find it harder to secure further gains following the recent strong advance.

The Euro-zone flash inflation data recorded a rate of 1.8% for September which was slightly higher than expected and increased speculation that the ECB would look to move away from extraordinary liquidity early next year. There were, however, still very important concerns surrounding the financial sector with a particular focus on the Irish banking sector.

The Irish government revised up its estimates of likely bailout costs for the banks and the data suggested that the Irish budget deficit could rise to above 30% of GDP. The Euro will still be vulnerable to fears surrounding the peripheral economies.

The US economic data was slightly stronger than expected and provided some dollar support, although the overall market impact was measured. There was a decline in jobless claims to 453,000 in the latest week from 469,000 previously while second-quarter GDP was at 1.7% from 1.6%. In addition, the Chicago PMI index rose to 60.4 from 56.7, maintaining the recent run of erratic readings for the regional PMI indices.

There was some increase in volatility ahead of the month-end with the Euro consolidating above 1.36 after finding support on dips to the 1.3570 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was speculation over corporate and institutional month-end capital flows back to Japan on Thursday which provided some degree of support for the Japanese currency. There was still a high degree of caution over yen buying given the persistent threat of intervention by the central bank at these levels.

The Japanese economic data was mixed as stronger than expected releases for housing starts and retail sales were offset by a third successive decline in industrial production. Doubts over the manufacturing sector will maintain pressure for yen gains to be resisted. The dollar still dipped to test support below 83.20 in Europe on Thursday with dollar selling still a notable feature.

The US economic data provided some degree of relief for the dollar and it rallied to the 83.50 area, but still found it very difficult to secure buying support.

Sterling

After some respite on Wednesday, high volatility was again a notable feature during Thursday. The UK currency secured an initial boost from the latest housing data with the Nationwide reporting a 0.1% increase in prices for September. The UK currency pushed sharply higher with an attack on resistance above 1.59 against the dollar with Sterling demand against the Euro ahead of a scheduled EU payment

Once this payment was completed, Sterling support weakened and there was notable stop-loss Euro buying as traders pushed Sterling weaker. The UK currency fell to a four-month low near 0.8680 against the Euro and also fell to test support below 1.57 against the dollar before finding some respite.

There was further speculation that the Bank of England could consider further quantitative easing at the October meeting, although MPC member Posen was slightly more cautious in comments on Thursday. The PMI manufacturing release will be important for Sterling sentiment during Friday.

Swiss franc

The dollar found support close to fresh record lows near 0.97 against the franc on Thursday and rallied to test resistance above 0.98 later in the US session. The franc came under fresh pressure against the Euro with lows near 1.34.

There was a decline in defensive franc demand against the Euro with recued fears over the Euro-zone financial sector as a while as European banks required reduced liquidity from the ECB. The dip in franc demand came despite a high degree of unease over the Irish banking sector and safe-haven demand could return quickly given the underlying stresses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

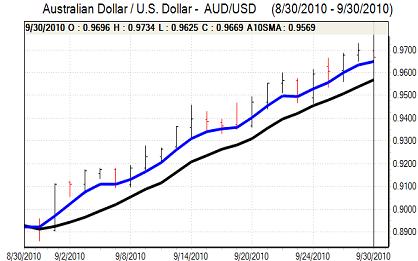

Australian dollar

The Australian dollar found support below 0.97 against the US currency in local trading on Thursday and pushed to a high above 0.9730 as markets looked to push the currency higher.

The domestic data provided no support for the Australian currency with a larger than expected 4.7% decline in building approvals for August while credit growth was also weak. There are liable to be growing risks surrounding the domestic economy which could pose an important threat to the currency.

There was a more cautious attitude towards risk later in US trading and commodity currencies were subjected to selling pressure and the Australian dollar dipped to lows near 0.9625 before finding fresh buying support.