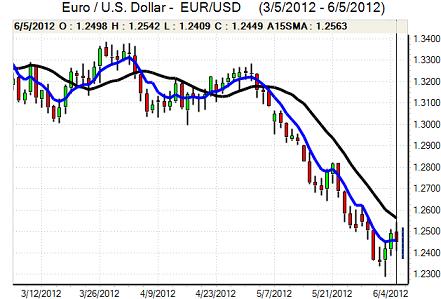

EUR/USD

After finding support below the 1.23 level following the US payroll data, the Euro rallied to a high above 1.25 as it looked to correct over-sold conditions. Spain remained a very important market focus as fears surrounding the banking sector continued to intensify. Prime Minister Rajoy again stated that the situation was extremely difficult and the Finance Minister also admitted that credit markets were closing down for Spain.

There were increased fears surrounding the banking sector and the ability to fund the budget deficit. There were reports that Germany was pushing Spain to accept a bailout from the IMF and EFSF and also rumours that Spain was resisting these pressures, although there was an indirect request for banking-sector aid.

Although there were some German hints over a move to a tighter political and banking-sector union, there was little in the way of detail. G7 held an emergency meeting to discuss the Euro-zone situation and pledge to act speedily, but there were no solid proposals. There was no comfort from the Euro-zone economic releases as retail sales 1.0% for the month. The Wednesday ECB meeting will be a key focus with strong pressure for additional policy measures by the central bank.

Following the weaker than expected 69,000 payroll gain for May, markets remained on alert over US releases and Fed comments. The ISM non-manufacturing index edged higher to 53.7 for May from 53.5 previously. In confirmation of a more subdued labour market, the employment component weakened to 50.8 from 54.2 previously which suggested only a marginal increase in payrolls. Regional Fed President vans called for monetary policy to remain extremely accommodative.

Although disappointment over the G7 tone, pushed the Euro back towards the 1.24 level, there was no major selling pressure and a recovery in risk appetite helped trigger a fresh move to the 1.25 area in Asia on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below the 78 level against the yen and rallied significantly during Tuesday following the G7 meeting with a peak in the 78.95 region.

Finance Minister Azumi stated that there was G7 backing to curb excessive yen moves and this increased speculation both over fresh Japanese intervention and alack of resistance to such a move by other G7 members. Azumi, however, was vague when pressed for details and there were renewed suspicions that Japan was effectively isolated over intervention.

There was still underlying defensive demand for the yen as risk appetite was undermined by falling equity markets and fears surrounding the Euro-zone. A firmer tone in Asian equity markets and speculation that China could cut interest rates weakened the yen to near 79 in Asia on Wednesday.

Sterling

Sterling has remained generally on the defensive during the UK Holiday period and found it difficult to rebound far from four-month lows below 1.53 against the dollar hit on Friday. The more defensive tone was illustrated by a Euro recovery to above the 0.81 level.

Domestic confidence was undermined by a much weaker than expected manufacturing PMI index with a decline to 45.9 from a revised 50.2 which increased fears surrounding the economy.

There was increased speculation that the Bank of England would move quickly to add additional stimulus through another round of quantitative easing at this week’s MPC meeting.

There was also evidence that Sterling was finding it more difficult to gain additional support on defensive grounds, especially with fears over the impact of Euro-zone stresses on the economic performance and banking sector.

Swiss franc

The dollar pushed to fresh 15-month highs above 0.97 against the franc following the US employment data before retreating to the 0.96 region. There were brief flurries of Euro gains, but it was unable to sustain the advance and weakened back to test support just above the 1.20 level with further evidence of persistent National Bank intervention.

There was further market speculation over the possibility of capital controls or negative interest rates to help prevent a breach of the 1.20 minimum Euro level.

Following a run of more favourable data, there was a sharp dip in the latest Swiss PMI reading which increased unease over the economic outlook.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

After finding support below the 0.96 level, the Australian dollar rallied to a peak above the 0.98 level before stumbling again.

The Reserve Bank of Australia cut interest rates by 0.25% which was the consensus expectation. There had, however, been some speculation over a 0.50% reduction which triggered some currency relief following the decision.

There were also expectations of some additional Chinese policy action to support the economy which helped curb selling pressure on commodity prices. The latest GDP data was also sharply higher than expected with a 1.3% quarterly increase which boosted the currency to a peak above 0.9850.