EUR/USD

The flash Euro-zone PMI manufacturing index fell to 50.4 for July from 52.0 previously which was the lowest reading for 23 months while the services-sector index also dipped sharply to 51.4 from 53.7 previously. There were increased fears surrounding the economy which would also increase pressure on weaker economies within the Euro area.

As EU leaders prepared for the emergency Summit, reports that the Greece could be put into selective default undermined confidence and pushed the Euro to lows below 1.4150. The currency swiftly reversed losses with strong gains from the New York open as markets grew more confident over the outcome and there were suggestions that the ECB would not block any deal.

The EU leaders agreed a EUR109bn support package for Greece. The ESFS fund will be expanded and have a bigger future role as it would be able to buy secondary bonds if necessary to prevent contagion. Interest rates on ESFS bonds will also be lowered to 3.5% which ease the loan-repayment burden on weaker economies. There will be debt write-downs of around 20% on private-sector bondholders while the ECB indicated that it would continued to accept Greek bonds as collateral even if Greece is declared in temporary default. The Euro gained relief on an easing of immediate contagion fears, although the political implications will also be watched very closely given the potential for substantial opposition within Germany.

There were further negotiations surrounding the US debt ceiling, but rumours of a deal were denied by congressional leaders as the deadline moved closer. Failure to secure any deal by Monday would tend to undermine dollar confidence. The Philadelphia Fed index rose to 3.2 for June from -7.7 previously while jobless claims rose to 418,000 from 408,000 previously. The dollar pushed to a high just above 1.44 as immediate fears eased before consolidating close to this level during the Asian session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar hit resistance close to 79 against the yen during Thursday and retreated sharply during the US session with four-month lows near 78.25 before a recovery to the 78.60 area.

The yen resisted selling pressure even though there was an easing of risk aversion as Euro-zone fears declined. The dollar was unable to gain support on yield grounds with investors still concerned over the debt-ceiling negotiations and these uncertainties tended to have a bigger impact as Euro fears diminished.

There was some speculation that the would be an easing of speculative positions and a reduction in short yen positions as new rules on leveraged accounts come into force in early August. Finance Minister Noda continued to warn over the intervention threat.

Sterling

Sterling found support on dips to the 1.6130 area against the dollar in Europe on Thursday before rallying strongly during the European session as the Euro rallied and the US currency came under heavy selling pressure.

The UK retail sales data was slightly stronger than expected with a 0.6% monthly increase for June following a revised 1.3% decline the previous month as non-food sales recovered ground, but there was still little increase for the second quarter. The latest government borrowing requirement of GBP12.0bn pushed the deficit for the first quarter of the fiscal year to GBP39.2bn from GBP39.5bn last year. Uncertainty over the economic environment will continue and there will be expectations of a weak second-quarter GDP reading next week.

There will be some debt write-downs for UK banks as part of the Greek bailout package, but there will also be relief that the immediate contagion threat has been lifted. Sterling rallied to a high above 1.63 against the dollar while the Euro held above 0.88.

Swiss franc

The Euro found support on dips towards 1.1620 against the franc on Thursday and rallied strongly following leaked reports of the EU summit draft with highs near 1.18. The dollar found support below 0.8150, but was unable to make any headway despite a spike higher in early US trading.

There will be some easing of immediate defensive franc demand as the contagion threat surrounding the Euro-zone is lifted, although the Euro is still weaker than when Greece passed its austerity programme in June.

Domestically, there was a sharp decline in the ZEW business confidence index to -58.9 for June from -24.3 which will increase fears over a sharp slowdown and will maintain pressure for National Bank action to curb franc gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

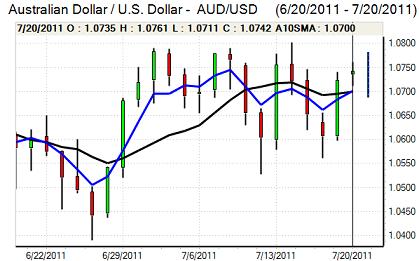

Australian dollar

The Australian dollar found support close to 1.07 against the US dollar on Thursday and rallied strongly during the New York session. There was relief that the Euro-zone contagion risk had been lifted for now which bolstered risk appetite and boosted demand for the Australian dollar as momentum buying pushed it to a high near 1.0850.

There were still some reservations over the Asian and Chinese economic outlook which created some caution over the outlook for commodity prices and Australian exports.