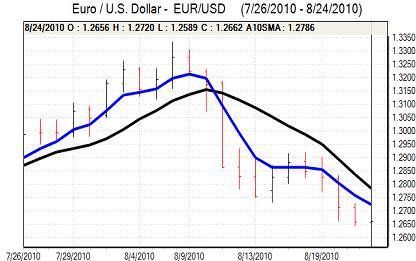

EUR/USD

The Euro remained under downward pressure during the European session on Tuesday as a wider lack of risk appetite remained an important negative factor for the currency. Stronger than expected Euro-zone industrial orders data did not have a significant impact with markets much more concerned over the economic outlook and the currency dipped to test support levels below 1.26.

The US housing data was substantially weaker than expected with existing home sales falling 27% to an annual rate of 3.83mn. Although a sharp decline was expected following the ending of tax credits, the decline increased fears that the US economy will slide back towards recessionary conditions and prompt more aggressive quantitative easing by the Federal Reserve. The dollar weakened following the data with the Euro moving back above 1.27.

Weak economic data also enhanced the mood of risk appetite which limited the scope for Euro buying as some defensive buying of US Treasuries and the dollar continued. The Euro was also undermined later in the day by a downgrading of the Irish credit rating to AA from AA1 by Standard & Poor’s.

The downgrade due to fears over the cost of bailing out the banks also renewed market fears over the Euro-zone structural outlook. The Euro retreated back to the 1.2650 area, but resisted a re-test of recent lows. A stronger than expected German IFO report could provide some degree of support for the Euro on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar lost support in the 84.75 area against the yen in Europe on Tuesday and then weakened sharply to lows below 84 which represented a fresh 15-year low for the US currency. There was disappointment that the Finance Ministry and Bank of Japan decided against any immediate measures to weaken the Japanese currency while there was no sign of intervention.

Risk appetite remained weak as equity markets declined and there was also stop-loss selling following the break of technical support with large investors also looking to test the central bank’s resolve.

The dollar found support below 84 and the yen weakened after Finance Minister Noda commented that he was ready to take appropriate action. Intervention speculation remained extremely high on Wednesday which curbed yen support. Comments from G7 officials will be watched very closely as any intervention will be much more effective if there is multi-lateral support for any Japanese action.

Sterling

Sterling remained under downward pressure against the dollar in Europe on Tuesday with lows near 1.5370 against the dollar as the US currency continued to gain defensive support. The trading pattern was similar to that in previous days with Sterling maintaining a firm tone against the Euro.

Sterling was undermined by the wider deterioration in risk appetite while the domestic policy concerns also increased. New MPC member Weale stated that there was a risk of the economy moving back into recession which undermined confidence and there will be continuing fears over the outlook for consumer spending.

Sterling did recover back to above 1.54 against the dollar as the US currency retreated. There will also be some further important UK protection from a serious lack of confidence in the US and Euro-zone fundamentals.

Swiss franc

The Swiss franc continued to gain important defensive support on Tuesday as confidence in the global economy continued to deteriorate. After relief the previous day, the Euro weakened to fresh record lows near 1.30 against the Swiss currency.

In this environment, the dollar also came under pressure with a test of support below the 1.03 level.

Fears over the global economy and renewed unease over the Euro-zone structural outlook will continue to provide short-term defensive support for the Swiss franc and the currency resisted any significant selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

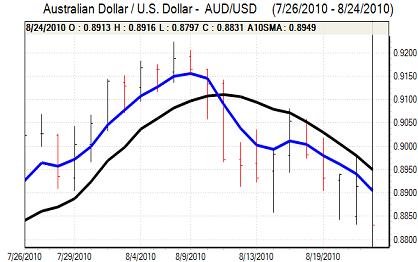

Australian dollar

The Australian dollar was undermined by falling risk appetite in European trading on Tuesday and weakened to test support near the 0.88 level against the US dollar. There was support close to this level and the currency secured a tentative recovery to the 0.8850 area.

The currency has continued to be unsettled by a lack of confidence in the global economy, especially with commodity prices under downward pressure. There has been no agreement on the formation of a new government and the currency could be vulnerable to some selling pressure if there is no announcement soon. In contrast, suggestions that an agreement could result in changes to the mining tax would support the currency.