EUR/USD

The Euro remained firmly on the defensive during Tuesday and tested support levels below 1.30 for the first time since mid September before stabilising just above this level.

As has been the case over the past few days, the market was dominated by developments within the Euro-zone and increased market fears over the Euro outlook. There was a further widening of yield spreads and credit default swaps during the day. Although again focussed on Spain and Portugal, there was also a widening of spreads for countries such as Belgium which indicates that stresses are spreading.

Confidence was undermined further by a warning by Standard & Poor’s that Portugal’s credit rating was liable to be downgraded while there was also speculation that the Irish bailout package could be rejected by parliament. There was some relief that there was no action on France’s credit rating by the agencies.

The Thursday ECB meeting will be very important for market sentiment with the central bank under strong pressure to act decisively to restore market confidence. There will also be speculation that the ECB will be forced to move away from plans to withdraw the extraordinary liquidity.

The US economic data was slightly stronger than expected with an increase in consumer confidence to 54.1 from a revised 49.9 the previous month while the Chicago PMI index rose to the highest level since May. The data should provide some degree of dollar support, especially if the labour-market data is stronger than expected on Wednesday. The Euro continued to consolidate just above 1.30 in Asia on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to gain any renewed support on Tuesday and weakened to lows just below 83.50 against the Japanese currency.

International risk appetite remained generally weaker as the Euro-zone stresses continued to dominate markets. There will be further speculation over capital repatriation from European bonds which will tend to underpin the Japanese currency, especially if wider risk appetite fades.

The latest Chinese PMI data was slightly stronger than expected which will support near-term hopes over the Asian economic outlook, but there will also be fears that the Chinese authorities will have to tighten monetary policy further which would undermine risk appetite.

The dollar remained generally on the defensive in Asia on Wednesday with the US currency below the 83.80 level.

Sterling

Sterling maintained a weaker tone against the dollar in Europe on Tuesday and dipped to test support below the 1.55 level for the first time in over two months. Sterling found support at lower levels and rebounded to near 1.56 while it made further progress against the Euro with a high near 0.8320.

There will still be unease over the domestic economy with expectations of a renewed and potentially sharp slowdown early in 2011 as tax increases come into effect. The latest Nationwide house-price data recorded a further decline in prices for November and overall consumer spending has been subdued.

For now, the UK relationship with the Euro-zone economy will remain very important for Sterling valuations. Sterling will still tend to gain some protection from the lack of confidence in the Euro area with potential defensive inflows. There will, however, also be unease over the UK impact, especially with concerns that the banking sector will be vulnerable to renewed stresses.

In this environment, there is certainly the risk that Sterling sentiment will reverse rapidly, but the currency was holding steady in early Asia on Wednesday.

Swiss franc

The Euro found some support below 1.30 against the Swiss franc on Tuesday and managed to regain this level during the session. The dollar was also able to find support blow parity and edged higher during the US session.

Stresses within the Euro-zone will remain an extremely important focus in the near term and the will be defensive inflows into the currency on persistent fears over the Euro-zone outlook. Markets will be monitoring comments from the National Bank closely given the potential for renewed fears over deflation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

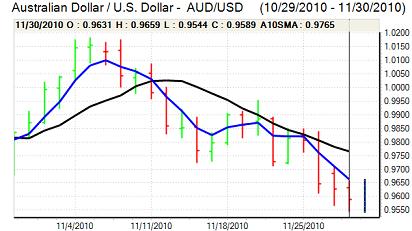

Australian dollar

The Australian dollar was unable to regain the 0.9650 level against the US currency during Tuesday and generally drifted weaker in choppy trading conditions.

Domestically, the latest GDP data was weaker than expected with growth of 0.2% for the third quarter compared with 0.5% and this put the currency under fresh pressure with renewed fears over a slowdown in the economy.

With underlying risk appetite also weaker, the Australian currency weakened to 2-month lows near 0.9520 against the US currency before finding some buying support. Although the Chinese data was firmer than expected, doubts over the sustainability of the situation will continue.