There have been a lot of challenges for the markets in the past few months, from unrest in the Middle East to the disaster in Japan to ongoing Eurozone debt issues to a potential U.S. government shutdown. The big, overarching question for most investors and consumers is how these factors have affected the price of goods and services (inflation) and our savings and lending rates (interest rates). For you as a trader, the question is how these factors may create trading opportunities.

The U.S. Federal Reserve has been engaging in rounds of quantitative easing (QE1 and QE2) to provide market liquidity, and has held its key interest rate near zero since December 2008. Even though other nations are starting to realize the threat of inflation and increase their key interest rates, I don’t see the Fed following that course this year. As a result, don’t expect much upside from the U.S. dollar. I believe that as a result, commodities, most of which are priced in dollars, should remain bullish this year. Commodities have been in rally mode across the board. You can bring up nearly any commodity chart and see the slope from left to right.

The European Central bank just raised its key short-term lending rate to 1.25 percent, the first increase since 2008. ECB President Trichet left the door open to further increases, stating “we always do what is necessary to deliver price stability over the medium-term.” Currently, market participants anticipate rates in the Eurozone may move up to 1.75 percent by year-end.

The ECB’s move follows on the heels of a rate hike in China. The Chinese central bank has risen its benchmark lending and deposit rates three times since mid-October. Other central banks that have been tightening amid the threat of inflation include India, Poland and Sweden.

U.S. Treasuries

Before we get into a look at specific markets and trading strategies, let’s look at basic short-term vs. long-term interest rates, and how they vary. Typically, longer-dated instruments, such as 10- or 30-year U.S. Treasury notes and bonds, will carry a higher rate (yield) than short-term instruments such as money markets, Eurodollars, or T-bills. Why? If I take $100,000 from you and promise to pay it back in 30 years, that money is tied up for a long period of time. The risk of inflation is greater over 30 years—my money might not be worth as much when I get it back, and I’ve lost it to invest elsewhere. So, I would naturally demand a greater rate of interest to loan you that money over 30 years than if I only loaned it to you for one day.

Keep in mind the price of a bond moves inversely to its yield. That is because newly issued bonds will offer higher yields when prevailing interest rates rise. Existing bonds with lower rates become less competitive in the market, so they would command a lower price when traded between buyers and sellers. Let’s see how these factors have affected U.S. Treasury instruments.

The chart looks to be in a bear market. That means futures prices are going down. I think this bearish trend is likely to persist in the medium-to long-term, and I would recommend traders consider taking short positions in bond and note futures, but wait for short-term rallies up to establish positions at more favorable prices. The areas of 123 or 125 in June bond futures look like good areas to sell (marking key resistance), with a stop at 124 and 126, respectively.

Inflation is coming, and in fact, in commodities, it’s here already. That should bring even lower prices in bond and note futures. On the short end of the yield curve, if policy changes to become less accommodative that would create good opportunities in short-term instruments such as Eurodollars. Watch for language from Fed officials that we will not see a QE3, hints about rate increases or mounting inflation concerns.

Currencies

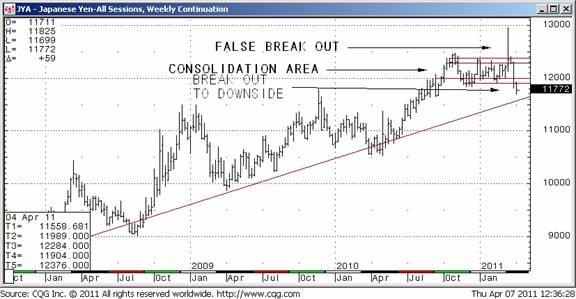

When a currency gets out of control, policymakers will often intervene. We can see this in the yen. See the spike on the chart then the subsequent drop. This spike came after the earthquake and tsunami in March, and an intervention by the Group of Seven industrialized nations which followed.

The yen had been in a bull market, but the yen is expected to weaken further amid Bank of Japan easing moves. The country needs liquidity to rebuild. And, their GDP is likely to contract as a result of this disaster, at least in the short-term. The pre-intervention spike seemed to be a false breakout, in my opinion. Right now, I am advising my clients to consider selling the bottom end of the pre-intervention range around 119 – 122, and risk about a point on a trade, depending on your risk tolerance. If that doesn’t work out, you might want to be patient and might consider re-establishing a short trade around 123 with a stop near 125.

Without any likely tightening action from the U.S. Fed, if the ECB continues to raise its interest rates, and get deficits on the continent under control, we should see the euro continue to move higher and the U.S. dollar lower. Of course, these moves aren’t always in a straight line—I’m talking about the longer-term, big picture trend. If, on the other hand, we see signs of action from the U.S. Fed, then this trend should reverse, in my opinion. We should see a short-covering rally in the dollar and a paradigm shift.

For now, I think buying the euro on dips seems like a favorable strategy. Traders might consider buying June futures at 140.40, with a stop at 139.40 (risking a point). If the market sees a close under the 10-day moving average at 138.40, I would likely change my thoughts in this regard. But I’d want confirmation that the U.S. might begin tightening to really change my mind about the euro’s direction. The euro needs to close under 135 to really solidify a trend reversal on a technical basis.

These are my general thoughts and trading ideas at this point in time, and not to be taken as specific trading recommendations. These ideas may change at any time as conditions change in the markets. For more specific strategies tailored to your unique risk tolerance and goals, I encourage you to contact me.

Jeff Friedman is a Senior Market Strategist with Lind Waldock. He can be reached at 866-231-7811 or via email at jfriedman@lind-waldock.com.

Futures trading involves substantial risk of loss and is not suitable for all investors.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

(c) 2011 MF Global Ltd. All Rights Reserved. 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL 60604. www.lind-waldock.com