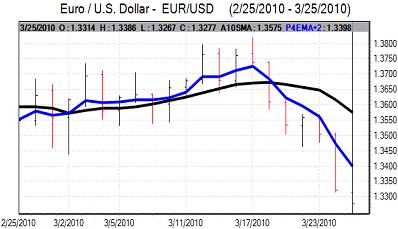

EUR/USD

The Euro dipped to lows below 1.33 against the dollar in early Europe on Thursday before finding some support and edging firmer.

Developments within the Euro-zone remained a key market focus during the day as political and economic negotiations continued. The Euro gained initial support from an ECB announcement over collateral arrangements. The bank announced that BBB-rated securities would be accepted beyond the scheduled end-2010 deadline and this provided some degree of reassurance that Greece would be less vulnerable to financing difficulties.

At the start of the 2-day EU summit there was evidence of an agreement to provide a support package for Greece with the French government reluctantly agreeing to German demands for IMF involvement. Initial relief for the Euro over a potential deal was soon reversed as ECB President Trichet called possible IMF aid for Greece very, very bad which fuelled speculation over a rift with the central bank.

The economic data was also generally weak with money supply contracting slightly according to the latest release The Euro was unable to regain the 1.34 level against the dollar and dipped fresh 10-month lows below 1.33 during US trading as confidence in the Euro-zone remained extremely weak.

Initial US jobless claims were lower than expected with a decline to 442,000 in the latest week from 454,000 the previous week which maintained a degree of optimism towards the US economy. There was a further increase in bond yields which should provide support to the dollar as it remained firm on a trade-weighted basis, although Euro-zone developments may dominate for now.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was evidence of exporter selling above the 92 level which curbed a further dollar advance during Asian trading Thursday, but the Japanese currency was still unable to make any significant headway amid expectations of further capital outflows. The dollar was holding just below 92 in early Europe as the Euro remained the dominant market focus.

As happened on Wednesday, the dollar secured further strong buying support in US trading with the yen undermined by a rise in US bond yields. There was also evidence of yen selling by major funds which pushed the dollar to highs near 93 and this was the strongest dollar level since early January. The yen also lost ground against the Euro during the day.

Sterling

Sterling was able to hold above 1.49 against the dollar in early Europe on Thursday. The February retail sales report was significantly stronger than expected, with a 2.1% increase but this followed a revised 3.0% decline the previous month. The data provided some reassurance over near-term spending trends, but there was still a high degree of caution over economic trends and an initial Sterling spike soon faded.

Budget policies remained an extremely important focus and there was still very little confidence over the prospects for a credible medium-term plan to cut the deficit. There were also persistent fears over the political outlook and risk of an indecisive election result which could intensify the risk of budget inaction.

Sterling was unable to regain the 1.50 level against the dollar and retreated back towards 10-month lows just above the 1.48 level. From a two-week high near 0.8880 against the Euro, Sterling also retreated to lows near 0.8990 during US trading.

Swiss franc

The dollar found support below 1.0680 against the franc on Thursday and again pushed to highs near 1.0750 during New York trading. Dollar moves were dampened to some extent by moves on the crosses. The Euro failed to sustain initial gains and weakened to re-test lows below 1.4550 as franc sentiment remained strong on a lack of Euro confidence.

There were unusual comments on the economy during Thursday with government ministers and the president both expressing unease over franc strength. The government has little influence on policy, but there will still be additional pressure on the central bank to curb franc strength.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

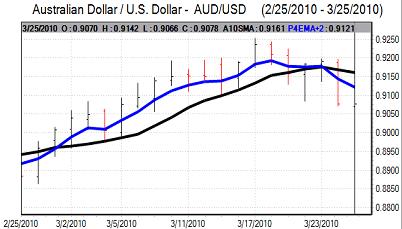

Australian dollar

There was an Australian dollar rally to the 0.9140 area against the dollar in Asian trading on Thursday. The currency was unable to sustain the advance and weakened to lows around 0.9070 against the US currency.

General dollar strength was the main feature and the Australian currency was still generally resilient Comments from the Reserve Bank that interest rates would need to move to more normal levels were significant in curbing selling pressure.