EUR/USD

The Euro was unable to secure any further buying support on Friday and retreated to fresh two-month lows close to 1.32 against the dollar as underlying sentiment remained weak.

The contagion threat remained the key negative influence for the Euro with persistent fears that the debt crisis and impact of widening yield spreads would create further stresses within Portugal and Spain with Italy also seen as potentially vulnerable given the underlying public-debt burden.

Over the weekend, negotiators formally agreed a EUR85bn support package for Ireland to underpin the banking sector with Ireland also given more time to cut the budget deficit. A majority of the support will come from EU members with the IMF making a EUR22.5bn contribution. The Euro gained initial relief from the deal and jumped higher in early Asian trading on Monday.

In a continuation of recent trends, the Euro was unable to sustain the gains and weakened to test support below 1.32 before a tentative recovery as the currency was unable to shake-off the contagion fears with further fears that Spain would be subjected to renewed selling pressure. Medium-term confidence in the Euro has also deteriorated further with intense media discussion over the possibility of a break-up.

There were no major US economic developments in the US on Friday with market liquidity weak following the Thanksgiving holiday on Thursday. There will be some cautious optimism over the recent growth trends, but there will still be very important reservations, especially with the monthly payroll release due this Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make much headway against the yen on Friday, but did find solid support with firm buying on dips towards 83.50 and edged higher during the day. The domestic data did not provide any market reaction with an annual 0.2% decline in retail sales slightly better than expected.

International factors will tend to dominate in the near term and the yen has remained vulnerable on the Korean issue as underlying tensions continue to simmer. North Korea warned over a declaration of war while South Korea has threatened more aggressive defence measures. The yen will remain vulnerable to some selling pressure if tensions escalate further.

In contrast, there will be some capital repatriation back to Japan on fears over the Euro’s medium-term outlook and this will provide some degree of yen support. The dollar maintained a firm tone in Asia on Monday, advancing to a 2-month high close to 84.20.

Sterling

Sterling was unable to gain renewed buying support against the dollar on Friday and retreated to 2-month lows below 1.56 as the European currencies maintained a negative tone against the dollar.

There will be relief that an EU-led support package has been agreed and it should lessen the risk of any further near-term fears over the UK banking sector. The situation will, however, remain precarious given the UK debt burden and high exposure to the Euro-zone.

The government Autumn statement on growth and borrowing is unlikely to have a major impact, although any upgrading of independent forecasts for the next year could improve sentiment slightly.

There will be concerns over the housing sector with a further monthly decline in prices according to the Hometrack survey and fears that the economy will slow very sharply during the first quarter of 2011, especially with the VAT increase taking effect.

Sterling briefly advanced in early Asia on Monday before re-testing support below 1.56 and it consolidated close to this level.

Swiss franc

The dollar continued to probe resistance levels above parity on Friday and was able to make small net gains even though resistance levels were tough to break down.

The KOF business confidence index weakened slightly for November, reinforcing expectations of a weaker economy over the next few months, but the index remained above the 2.00 level which will provide some relief.

There were renewed dollar gains in Asian trading on Monday and the US currency advanced to an 8-week high around 1.0070. Underlying Euro-zone fears should continue to provide defensive support for the Swiss currency in a European context.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

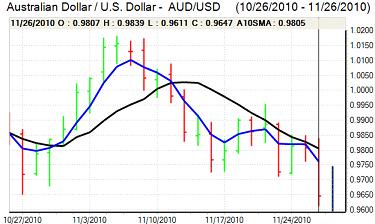

Australian dollar

The Australian dollar gradually weakened during the European session on Friday and dipped to test support near 0.96 against the US dollar. After spiking higher in early Asia on Monday, there was renewed selling pressure and a test of support close to 0.9580.

The domestic investment data was weaker than expected which reinforced the recent doubts over the economy.

Underlying risk appetite was also generally fragile with further unease over the potential contagion effect surrounding the Euro-zone economy, but there was a solid rebound from the 0.9580 area.