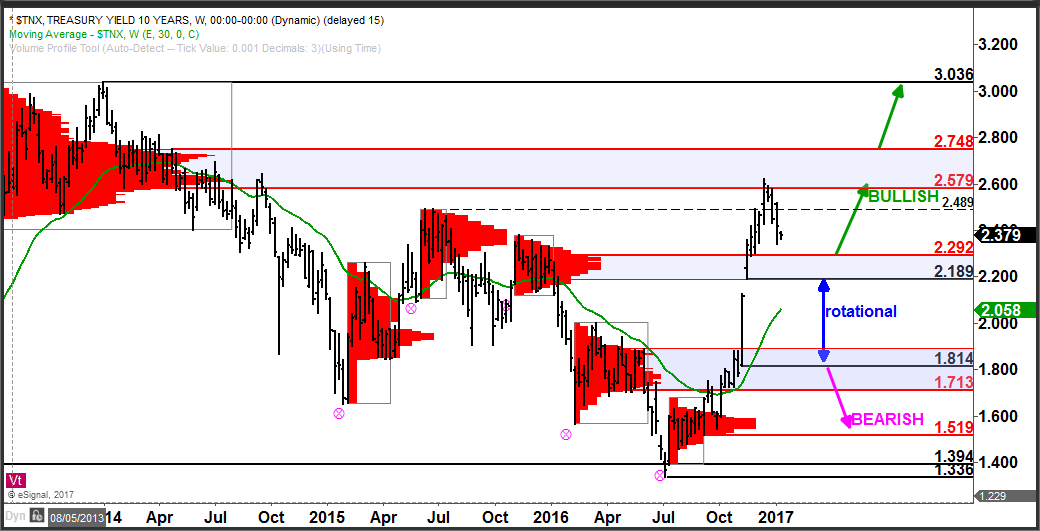

After a post-election surge, interest rates have been steadily and orderly pulling back following the mid-December high at 2.62. So why the pause in the rally? Is it over? Is it just beginning? Click here to watch a video explaining how to read markets using volume at price.

First off, the reason for the pause and pullback is due to rates running into the primary zone of overhead resistance at 2.579 – 2.748 (see chart).

You can see that this zone was established in late-2013 and early-2014, which was quite a long time ago. The fact that this zone is still respected is a testament to the robustness of using volume-at-price profiles (and in this case it’s proxy, time-at-price profiles) to do this sort of analysis.

On this pullback, there is support established at 2.189 – 2.292 and the bias will remain bullish while above this zone. The resistance zone at 2.579 – 2.748 must be overcome to open the door for another push higher toward 3.036.

If 2.189 were to be breached to the downside, the near-term bullish bias would be negated and further pullback toward 1.814 would become the new expectation. While above 2.189 – 2.292 however, the bullish bias remains intact.

After a post-election surge, interest rates have been steadily and orderly pulling back following