South African equities aren’t a market we hear discussed very often. While price action on the Johannesburg Stock Exchange might not make the nightly news, there does appear to be an interesting setup taking place in the iShares South Africa ETF (EZA).

What is unique about technical analysis is it can be applied to any market and any security. We can look at South African equities without being an expert on the country’s economy or political agenda. All we need is price – and we allow that to dictate our bias.

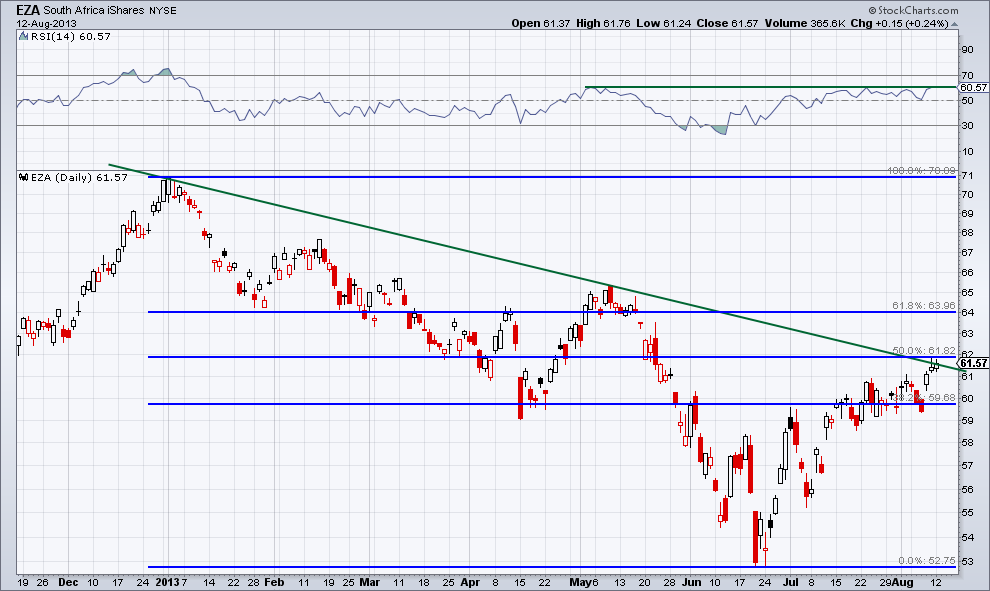

Below is a chart of EZA that shows the slide from its January high. South Africa has trailed the rest of emerging markets until it hit a low in June and began to rise. As price advances and attempts to break out from its six month down trend, it has hit resistance. As the chart shows we have a falling trend line that connects the January ’13 and May ’13 highs. We also have the 50% retracement of the downtrend sitting at $61.82. Both of these forms of resist intersect where price happens to be right now.

In May, EZA attempted to make a higher high but was unsuccessful as price eventually continued its descent. When we look at momentum via the Relative Strength Index (top panel of the chart) we see the 60 level acting as resistance for the indicator. We touched this level once in June and are now back at the 60 level as price battles its own resistance.

If the bulls are able to take out both the trend line and retracement resistance levels then it’s possible we see a test of the May high around $65.50. Otherwise the down trend may stay intact. Like I said before, we don’t see much discussion about this South African ETF, but it’s often important we don’t lose focus of some of the non-major markets as they can provide unique opportunities as well.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.