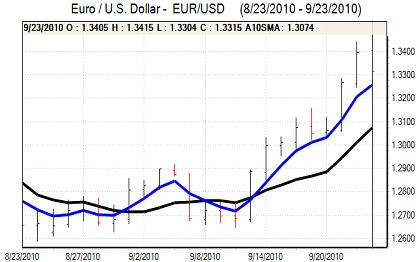

EUR/USD

The Euro held steady just above 1.33 against the dollar in early Europe on Friday and then secured strong gains during the day as the dollar remained under wider selling pressure.

The German IFO index was stronger than expected with a small advance to 106.8 for September from 106.7 previously and compared with expectations of a small monthly decline. There was a deterioration in the expectations component while the current conditions index was strong. The data helped alleviate the damage caused by the weak PMI data reported the previous day. The impact was magnified by the fact that there had been rumours of a weaker than expected result ahead of the data release. There will still be unease over the underlying Euro-zone financial-market stresses.

Headline US durable goods orders declined by 1.3% for August from a revised 0.7% increase the previous month, while there was a 2.0% increase in core orders. New home sales were unchanged at 288,000 for the August, unchanged from the revised estimate for July.

The economic data did not provide any significant dollar support on yield grounds with markets still focussed on the possibility of Federal Reserve quantitative easing within the next few months. The data did, however, tend to boost risk appetite which helped provide Euro support, especially with investors reluctant to back the dollar and yen.

The Euro pushed to a high just above 1.3480 against the dollar and retained the bulk of the gains later in the US session. Testimony from Fed Chairman Bernanke will be watched closely over the following week for further evidence on the Fed’s intent.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained fragile initially in Asia on Friday, but then advanced strongly against the yen on evidence of central bank intervention to weaken the currency. There were also rumours that Bank Governor Shirakawa had resigned which hurt the yen, although these reports were denied.

The dollar pushed to a high of 85.35 following the intervention reports before drifting back to the 84.85 area as the US currency was still undermined by the persistent lack of yield support. There was also no confirmation of intervention by the central bank.

This trend continued throughout Friday with the US currency again unable to gain support from the US data releases. The dollar dipped to a low near 84.10 before recovering back to the 84.35 area late in New York.

Sterling

There was a slightly weaker tone in Asia on Friday with Sterling still unsettled by fears over the underlying economic trends. There were no UK economic data releases during Friday which helped lessen market attention on the economy to some extent.

Technical considerations were important and the UK currency gained support from a break above the 1.5730 resistance area. With the dollar generally weak, Sterling pushed to six-week highs above 1.5820 against the US dollar.

There will still be a high degree of unease over the UK economic outlook and the latest PMI surveys will be watched closely over the next 10 days to assess the prospect for further Bank of England monetary easing. A lack of confidence in other major economies will continue to be a key factor in providing Sterling support by default with the Euro blocked near 0.8550.

Swiss franc

The Euro found support below 1.31 against the franc on Friday and strengthened steadily during the day with a weekly high above 1.3280. The dollar dipped to 30-month lows below 0.98 against the franc, but did find some relief and strengthened back to 0.9850 in US trading.

Risk appetite generally improved during the day which helped underpin the Euro and there was also a decline in defensive franc demand as immediate Euro-zone fears faded. There will still be a reluctance to sell the franc aggressively given underlying unease.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

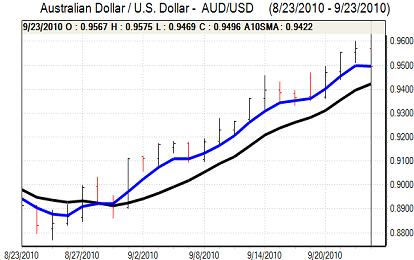

Australian dollar

The Australian dollar found support below 0.95 against the US currency on Friday and strengthened steadily during the day. There was a familiar combination of wider US dollar weakness and an improvement in risk appetite which helped support the Australian currency.

As Wall Street advanced, the Australian currency strengthened to a fresh 2-year high above 0.96 before correcting slightly weaker. Markets will be on alert for Reserve Bank Australian dollar sales over the forthcoming week as the bank is likely to take advantage of recent strength to sell into rallies.