US stock futures point to a slightly higher open this morning after lofty gains on Monday. Foreign markets spent another day recovering as the Nikkei rose 4.5%, but investors were more restrained trading the American markets overnight. While the apocalyptic headlines regarding the Japanese nuclear situation seem to have disappeared, the IAEA remains cautious. Radiation readings 20km from the Fukushima Daiichi pant are 1,600 times the normal level. The most positive news to date is that Tepco has said it has connected cables for permanent power to the No 4 reactor, and expects to complete all four reactors this afternoon.

On the Libyan front, the Financial Times is reporting that there are some differing views in the UN on how to proceed in the country. A US-led coalition spent the weekend bombing various air-defense and communication centers in Libya in hopes of better enforcing a no-fly zone. President Obama has taken a more measured approach to foreign policy than his predecessor, insisting the US is not acting unilaterally and it hopes to cede control of operations to a NATO group in the coming days, not weeks. Libyan leader Moammar Gadhaffi continues to strike a pugnacious tone, equating the missile strikes to terrorism and vowing to fight a long and bloody war with the West.

For more market and stock specific commentary, watch the T3Live.com Morning Call video with Scott Redler and Alix Steel, below.

Also boosting sentiment yesterday was the proposed AT&T – T-Mobile deal, which now will have face close regulatory scrutiny as many opine it should not pass anti-trust clearance. The merger would create the largest US telecom provider and a virtual duopoly with Verizon in the mobile service sector. Investors are betting such two-pronged dominance of the market would have a very adverse effect on no. 3, Spring Nextel Corp. (S), which traded down more than 4% yesterday.

After a weak first quarter of 2011 for the stock market, conventional wisdom suggests the powers-that-be could push this market higher into the end of Q1. You will often see strong momentum into quarters’ end, with firms often hoping to avoid large losses. The market’s underlying direction continues to be higher, and without further deterioration in Japan, it seems like a matter of time before we are back on the highs. But with such a heavy dose of fear brought about by the three-part disaster in Japan, that process could be a little more dodgy than before.

As far as levels on the S&P, the market yesterday ran into resistance in the 1295-1300 area of the S&P and looks poised to at some point retest the breakdown level from the wedge pattern. With uncertainty still lingering in the world, it could be hard for the market to just blast off from this level. Remain cautious and look for more confirmation from the market.

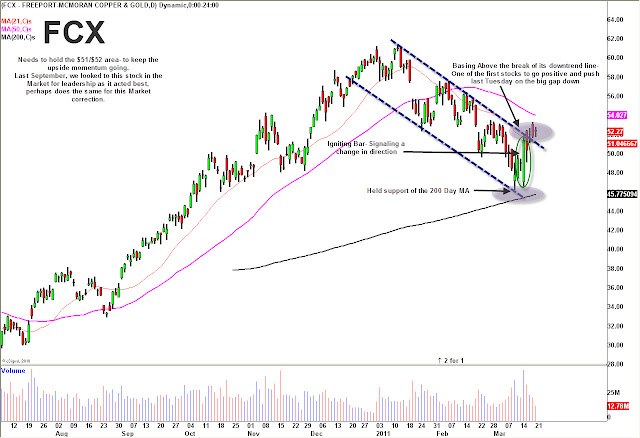

Now, lets get to individual stocks that are setting up well. Freeport-McMoran Copper & Gold Inc. (FCX) has been one of the strongest stocks in the market over the last two years, but has been a dog during 2011. The stock has been in a firm downtrend, but was among the strongest bouncers last week when the market caught a bid. Right now, FCX is poking its head out of that downtrend and basing in that area. If it can hold the $51-52 area, it should get back quickly to the $55-57 level. Keep a close eye on this one.

Crosswinds in Apple

Apple Inc. (AAPL) is an interesting case at this point in time, because there are strong breezes gusting in both directions right now for investors. In the end, though, the prevailing long-term direction for Apple is higher right now based on valuation, which should give active investors conviction to buy in this area. Weighing on Apple right now is the case of Steve Jobs, who continues to battle health issues. Reports this week have Jobs set to step down permanently from his post as CEO of Apple, where he is currently on a leave of absence. If he were to step down or pass away, AAPL would most certainly get hit very hard. Also holding AAPL down now are supply-chain issues in Japan. The company relies on several components manufactured in Japan, and the effect on the bottom line remains unclear. In addition to a compelling long-term value story, the proposed AT&T – T-Mobile merger would create millions of more potential iPhone users. From a technical perspective, there are better options out there than AAPL, but you should still be able to buy this stock for the long-term.

Baidu Looks Ready to Go

One such tech stock with a better technical set-up than Apple is Baidu.com, Inc. (BIDU). As the leading search engine in the fast growing Chinese market, Baidu obviously has tremendous growth opportunities. Although it carries a somewhat lofty valuation, to this point it has been justified through earnings growth. Technically speaking, BIDU has held up well as the market has gotten hit over the past couple weeks. BIDU has consolidated in a wedge pattern since its last earnings report in early February, and looks set to break back to highs above $130.

Magnet Likes Schlumberger, Altera, Silver Wheaton

T3Live.com contributor Jordan Kimmel is the founder of the Magnet Stock Selection Process, a proprietary system for finding stocks with significant upside potential. The Magnet system combines a series of criteria to find the most exciting stocks for active investors, while Kimmel also evaluates technicals to time entries. Three larger cap stocks that have shown up as highly ranked Magnet stocks recently are Schlumberger Limited (SLB), Altera Corporation (ALTR) and Silver Wheaton Corp. (SLW). For more information on these plays watch the Morning Call video above.

*DISCLOSURE: Scott Redler is long LVS, JDSU, SLV, F, BAC, GLD, NYX; Short SPY. Jordan Kimmel is long SLB, SLW, ALTR (among stocks mentioned).

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.