Following Tri Pointe Homes (TPH) IPO back in late January, Taylor Morrison Homes (TMHC) seeks to become the second homebuilder IPO this year, looking to cash in on the rebound in new housing starts. However, with the most recent economic data showing some softness – including this morning’s weak employment report – and with housing stocks cooling off lately, the timing of its IPO could be better.

THE FRAMEWORK

Headquartered in Scottsdale, AZ, TMHC builds in some of the areas that were hardest hit during the collapse (CA, FL, AZ) and focuses on designing homes for first and second time move-up buyers. TMHC was sold in 2011 by Taylor Wimpey, LLC, its British parent, to TPG Capital and Oaktree Capital Management for $955 million. After the IPO, TPG and Oaktree will each hold a 39.5% stake in the company.

It organizes its business into three geographic regions: East (46% of net sales orders), West (37%), and Canada (17%). During 2012, it closed just over 4,000 homes, comprising of 2,933 in the U.S. and 1,081 in Canada, with an average sales price of $364,000.

TMHC also made a significant acquisition on December 31, 2012, when it purchased the assets of Darling Homes for an initial cash payment of $115.0 million. Darling builds homes for move-up customers in 24 communities in the Dallas- Fort Worth area and 20 communities in the Houston market.

TMCH felt that this acquisition was a good fit as Darling is a well-established builder whose products complement its existing lines in Texas and its growth has been solid too. Revenue increased by 44% year/year in 2012 to $261.4 million, closing on 624 homes.

FINANCIAL REVIEW AND THE OUTLOOK

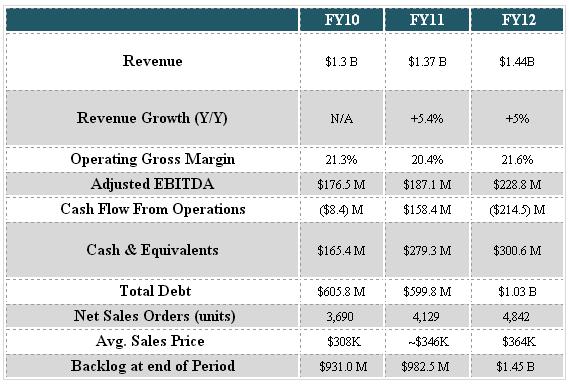

In regards to TMHC’s recent financial performance, there are reasons to be bullish on the name, but, there are also some notable blemishes. Looking at results for FY12, revenue inched higher by about 5% to $1.44 billion — due to tepid 2% home closing revenue growth — with financial services revenue spiking by 50% to $21.9 million. Gross margin has held firm over the past few years in the low 20% range, improving slightly in FY12 to 21.6% versus 20.4% in the year ago period.

As for backlog, that spiked by 47.5% to $1.45 billion, or to 4,112 homes compared to 2,965 homes as of December 31, 2011.

On the negative side, cash flow from operations for FY12 was ($214.5) million, with real estate inventory and deposits the main culprit, as it shelled out $331 million there. TMHC also has a lot of debt, currently standing at just over $1 billion.

Perhaps the most intriguing aspect about TMHC is the outlook it provided in its prospectus. Specifically, the company estimated that its total net sales orders totaled 976 homes for the two months ended February 28, 2013, which would equate to a 47% jump year/year. In terms of closings, it projects that it closed on 539 homes, good for a 40% bump. It also believes that total backlog grew by 31% for this two month period to 4,547 homes.

HOW TMHC STACKS UP

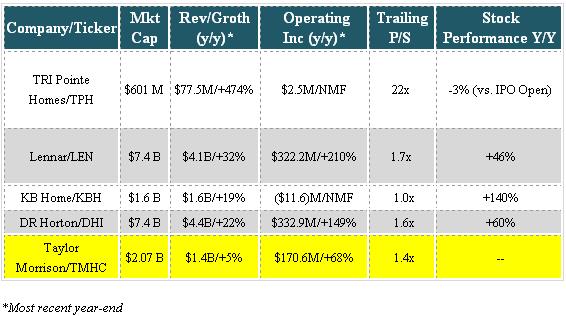

The first item that stands out is that it’s a crowded field. Along with the four stocks included in the table, Pulte Homes (PHM), Beazer Homes (BZH), Toll Brothers (TOL), and Hovnanian Enterprises (HOV) are also options for investors. In other words, the market is already pretty saturated with housing stocks.

What also stands out is that its topline growth is well below that of its peers. The good news is, its revenue growth is poised to ramp higher as its net sales orders and backlog have both jumped sharply higher. Of course, if cancellation rates escalate, this positive is mitigated.

On a trailing P/S basis, TMHC seems to be fairly valued at the mid-point of the IPO price range, which gives it a P/S of about 1.4x.

WRAP UP

In the IPO market, timing might not be everything, but it is important. Had TMHC gone forward with its IPO a month ago, this would be less of a concern as the recent batch of economic data and accompanying sell-off in housing stocks provides a headwind. There is also the concern regarding the glut of homebuilder stocks.

In terms of TMHC’s fundamentals, it’s a mixed bag. We were surprised to see that its topline only grew by 5% in FY12. That trails most peers by a wide margin. The good news is, its backlog of orders ramped up at the start of this year, and its recent acquisition of Darling Homes should provide a strong catalyst for growth.

TMHC’s recent financial performance does leave much to be desired, but, it does have intriguing potential going forward. Of course, there is no guarantee that its backlog will translate to solid revenue and earnings growth, and the housing recovery could also stall, especially if more existing homes come on the market.

Overall, though, if the housing market continues to improve this year like many economists predict, the stock should work well in 2013. Should it price and open poorly, this could open a compelling opportunity for buyers.