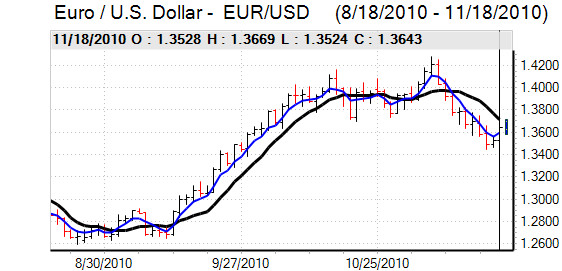

EUR/USD

The Euro moved higher in European trading on Thursday with further speculation that Ireland was poised to reach an agreement with the IMF and EU over a support package for the banking sector and wider economy. There were further discussion during the day and the evidence suggests that a deal could be reached on Friday, potentially in the region of EUR100bn to ease the government financing burden.

Expectations of an agreement supported the Euro and a move above 1.36 created some stop-loss momentum with highs near 1.3680 with the currency also gaining some support from a broadly successful Spanish bond auction.

There were still concerns over the contagion effect within the Euro-zone with the potential for selling pressure to intensify in countries such as Portugal. Underlying confidence in the Euro was, therefore, still fragile which curbed buying support.

The US data was generally supportive for the US currency as jobless claims edged lower to 439,000 in the latest week from a revised 437,000 previously. There was also a sharp rise in the Philadelphia Fed survey to 22.5 for November from 1.0 which helped offset the damage caused by the much weaker than expected New York survey earlier in the week.

Hopes for an improvement in US conditions helped stabilise dollar confidence and the Euro found it difficult to extend gains with solid resistance above the 1.3660 area. The dollar is also still being held back by wider doubts over fundamentals and the Fed’s policies.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 83 against the yen on Thursday and rallied firmly to a high near 83.80 as the yen also lost ground on the crosses.

The US currency gained some backing from the firmer than expected US data which boosted yield support while an easing of immediate tensions surrounding the Euro-zone also curbed defensive demand for the yen with reduced speculation over capital repatriation.

Domestically, the government also issued a generally downbeat assessment of the economy with comments that growth was at a standstill. The dollar was able to maintain a firm tone in Asian trading on Friday with consolidation in the 83.50 area.

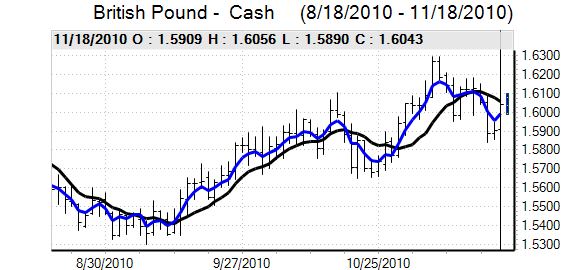

Sterling

Sterling found support close to 1.59 against the dollar during Thursday and gradually strengthened during the day with a move above the 1.60 resistance zone during the US session. Hopes for an Irish deal helped underpin the Euro against Sterling, but it was unable to make much headway.

The domestic influences were mixed as a stronger than expected headline retail sales figure for October was offset by downward revisions. There was an improvement in the latest CBI industrial trends survey which will sustain some optimism over the manufacturing sector and expectations surrounding Bank of England monetary policy remained broadly neutral.

There are still very important vulnerabilities surrounding the government borrowing situation with a GBP9.8bn requirement for October which was a record for that month. There is still some risk that underlying confidence in the UK debt situation will deteriorate rapidly which would expose Sterling to heavy selling pressure.

Sterling was able to consolidate above the 1.60 level as the currency gained support from a generally weaker US dollar with the Euro close to 0.85.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Swiss franc

The dollar found support on dips below 0.9880 against the franc on Thursday and advanced firmly to re-test resistance levels close to parity later in the US session. The Swiss currency fell sharply on the crosses with the Euro advancing to near 1.36 as immediate defensive demand for the franc eased in tandem with expectations of an Irish rescue package.

The Swiss economic data was weaker than expected as the ZEW expectations index fell to -30.9 for November from -27.5 previously which will reinforce expectations of a weaker economy. Although the export data was encouraging, there will be speculation that the National Bank will seek to engineer a weaker currency.

Australian dollar

The Australian dollar maintained a positive tone during Thursday and advanced to test resistance above 0.99 during the US session. The US dollar was generally weaker and there was also an improvement in risk appetite.

The markets will remain sensitive to the possibility of a Chinese interest rate increase and this will tend to curb buying support, especially with fears over a potential slowdown in trade growth. The currency struggled to sustain momentum and consolidated above 0.9850.