Key News

- China’s manufacturing sector continued to expand moderately in May as new export orders improved, two surveys showed on Monday, adding to tentative signs that the world’s third-largest economy is stabilizing. (Reuters)

- The pace of decline in Britain’s beleaguered manufacturing sector hit its lowest level in a year last month, reinforcing hopes that the worst of the economic slump could have passed. (TimesOnline)

- South Africa’s metalworkers union on Monday threatened to stage mass strikes if the country’s central bank did not change its policies and carry out deeper interest rate cuts. (Reuters)

Key Reports Due (WSJ):

8:30 a.m. Apr Personal Income: Expected: -0.2%. Previous: -0.3%.

8:30 a.m. Apr Personal Spending: Expected: -0.1%. Previous: -0.2%.

10:00 a.m. Apr Construction Spending: Expected: -0.9%. Previous: +0.3%.

10:00 a.m. May ISM Manufacturing Index: Expected: 41.5. Previous: 40.1.

Quotable

“The market always anticipates an economic recovery and, sometimes, it must be admitted, there are several false moves (“suckers’ rallies”) before the recovery takes

place. The current stimulus is so extensive globally that surely it will kick up the economies of at least some of the larger countries, including the U.S. and China, by late this year or early next year. (This seems about 80% probable to me, anyway.) anticipating this, we should expect a stock market recovery – which normally leads economic recovery by six months, plus or minus two – sometime between two months ago and, say, August, which the astute reader will realize implies that this rally may already be it. This was part of the logic behind my March posting, “Reinvesting When Terrified”: the uncertainties of the economy are so great that when the uncertainties of the stock market’s anticipation are laid on top of them, you simply must have big ranges of outcomes and hedge your bets. Unless you have extreme luck or divine guidance, you will never catch the low. Alternatively, there is still time – just – for another freefall leg, but time is running out. Investor confidence is still fragile, and should we get a series of particularly shocking data points, which, in the unique position we find ourselves is quite possible (say, one out of three), then confidence could crack one more time and the market could go to a new low before the major anticipatory rally I’m describing. (This would make the current rally a short-term head fake.) In a rally to 1000 or so, the normal commercial bullish bias of the market will of course reassert itself, and everyone and his dog will be claiming it as the next major multi-year bull market. But such an event – a true lasting bull market – is most unlikely. A large rally here is far more likely to prove a last hurrah … a codicil on the great bullishness we have had since the early 90s or, even in some respects, since the early 80s. The rally, if it occurs, will set us up for a long, drawn-out disappointment not only in the economy, but also in the stock markets of the developed world.”

Jerry Grantham, May 5th 2009

FX Trading – Is capitulation to the trend near?

Stocks are climbing the proverbial wall of worry indeed, evidenced by this piece in the Financial Times this morning:

“The majority of the world’s leading investors do not believe the recent strong performance of stocks and other risky assets is sustainable, according to a report released today.

“The FTSE All World equities index has surged more than 60 per cent since hitting a low for the year in March.

“But Barclays Capital has revealed that just 17.5 per cent of the 605 investors interviewed for its quarterly FX investor sentiment survey – including central banks, asset managers, hedge funds and international corporate customers – think risky assets have further to rise. This is one aspect of a generally gloomy outlook for the global economy, which undermines optimism that ‘green shoots’ of recovery are starting to emerge.”

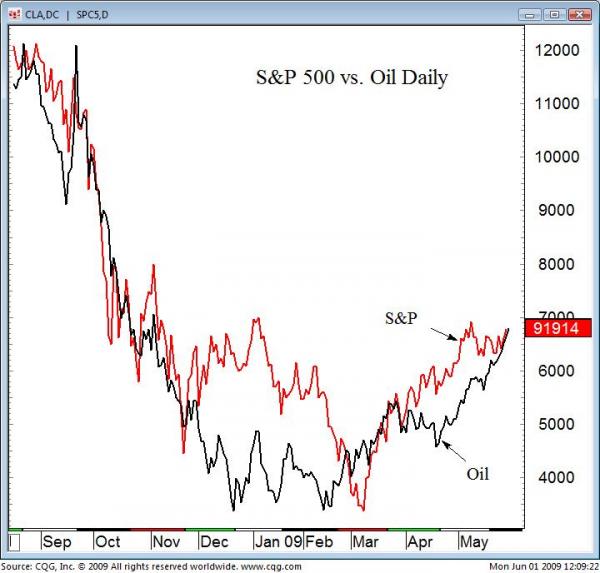

Oil hit a fresh high for 2009 this morning and stocks are bidding higher pre-market; both seem to be running on the same dynamic of growth optimism:

Is it time for the big boys to capitulate to this trend? The first key retracement area (38%), measured from the October 2007 high is 1018, which you can see in the daily chart of S&P 500 futures below (approximately 9.3% higher from here); not exactly an outlandish target…

And despite the fact correlations in some areas seem to be breaking down a bit, we would expect the dollar to continue to suffer if stocks work higher.

Jack Crooks

Black Swan Capital LLC