By: Marc Sperling

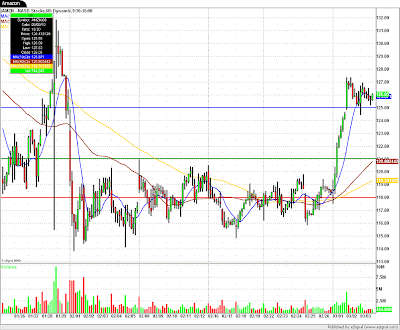

Last week I wrote that I was “swinging long some Amazon.” While my Tier 1 feeler position was stopped out with the large gap down on Thursday, I gained increasing confidence in the trade through $121 as AMZN held the lower end of its range and rallied back sharply. In trading the Tier System, what I lose in stopping out of my initial position is the right to be in the trade for full size on the break. While I did take a loss on my initial feeler, I was able to capitalize on the move higher and although I was not fully loaded for the move higher, I was able to more than make up for my initial Tier 1 loss. You can see from the chart that as soon as AMZN broke above $121 it did not look back and quickly reached my target in the $125 area.

I am seeing a similar trade setting up in Goldman Sachs (GS). The stock has been stuck in a tight range for the better part of two months now and is building a solid base. As of now, I am only testing out some feelers against shorter term levels, but on a break above $160 I will look to get aggressively long. Should Goldman breakout, then the market will most likely follow suit, putting my initial target of $165 comfortably within reach.